WuXi Biologics is an international contract research, development, and manufacturing organization (CRDMO) in the field of biopharmaceutics. It has recently proposed a spin-off of its subsidiary WuXi XDC, a crown jewel which is 60% owned by WuXi Biologics. It presents a valuable opportunity, given that recent successes in Antibody-drug Conjugates (ADCs) made it a bright spot in the global biologics space.

WuXi XDC commands about 10% market share globally in ADCs, while it leads with 70% market share within China. Currently, most of WuXi XDC projects are in the early stages. Recent figures put it at 110 integrated projects with about 16 of them in Phase II and III stages. The independent operation of WuXi XDC will enable WuXi Biologics to focus on its other business lines like monoclonal and bispecific antibodies.

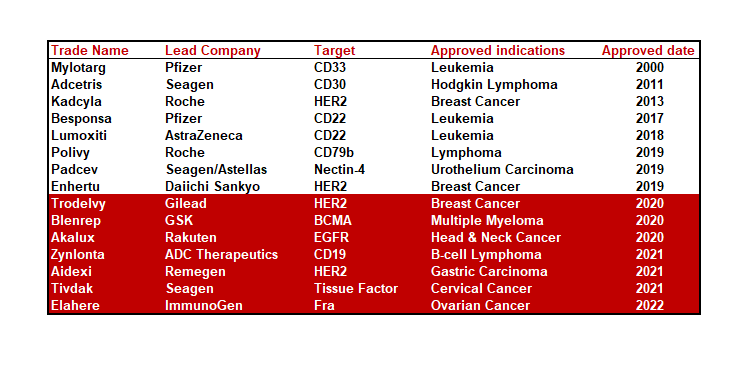

The interest in ADCs can be seen internationally from Pfizer’s proposed acquisition of Seagen. This US$43b deal ranks among the largest biopharma deals in recent times right behind the acquisition of Allergan by AbbVie for US$63b. The potential for ADCs is expanding due to the maturity, and hence increasing likelihood, for them to be used as first-line treatment owing to the efficacy over conventional cancer treatments.

With WuXi Biologics providing a one-stop solution along the entire value chain, they are able to capture growth opportunities from the demand of drug makers globally. As such, the company is expecting to grow its number of ADC projects by more than 30% annually into 2025.

That being said, there is a risk that international drugmakers may consider diversifying their exposure to China. Logistical delays and geopolitics may play a part in the consideration for outsourcing biomanufacturing to WuXi Biologics which is primarily operating in China.

Many will also recall the incident of the company being included in the Unverified List of the United States Department of Commerce back in February 2022. Subsequently, they were removed from the list at the end of 2022. On a more positive note, the biotech sector was not included in United States’ executive order earlier this month regarding a restricted list of high-tech investment.

Domestically, there is also a sector-wide overhang from the ongoing anti-corruption campaign which started in July 2023. By reason, WuXi Biologics should not be as impacted as other local biotech or traditional pharma companies.

However, sentiments may still spill across the entire industry chain and affect short-term business prospects. Previous government campaigns included the pharma audit in 2019 and substandard vaccine scandal in 2016. Looking over the headlines and assessed over the longer term, these corrective actions are certainly beneficial to the industry.

With over US$20b of total revenue backlog as of June 2023, Wuxi Biologics is hoping to cement its position as an industry stalwart. It now serves 573 clients, including all top 20 pharmaceutical companies in the world. By having dedicated and specialized facilities in close proximity in the cities of Wuxi, Shanghai, and Changzhou, the company's XDC unit does offer a unique proposition to clients by reducing the time from antibody DNA sequencing to bioconjugate IND filing.