Toyota has announced a blockbuster set of fiscal first half operational results, recording 5.6 million units of vehicle sales which is 8% higher than previous year ago period. Electric vehicles, a focus area highlighted by new CEO Koji Sato, made up a third of these vehicle sales. The Japan markets experienced strong growth, while other markets like North America and Europe also benefited from upwards price adjustments of the vehicles.

Perhaps the biggest contributor to Toyota’s financial performance will be the foreign currency positive effects in the near-term. With the macroeconomic environment in flux and Bank of Japan defending its monetary policy, there is an actual economic tailwind for large Japan exporters like Toyota. This is because a weakening of the Japanese yen will directly improve the profits made by these exporters selling into the international markets.

In fact, Toyota has updated its foreign exchange rate assumption from 125 to 141 yen per US dollar. This will lead to a nearly 40% increase in their operating income forecast for fiscal year 2024. After more than a year of supply chain disruptions in the auto industry, the company looks set to expand its lead and maintain their global leadership position in sales volume.

Despite all the positivity, there has been recent signs that electric vehicle demand has been slowing globally. For several months now, there have been price cuts by many competitors and introduction of lower-end models to appeal to the broader mass. Last month, the European Union also initiated an anti-subsidy probe into the imports of Chinese electric vehicles. A confluence of these market developments may introduce uncertainty into the industry and slow down the adoption trend of electric vehicles.

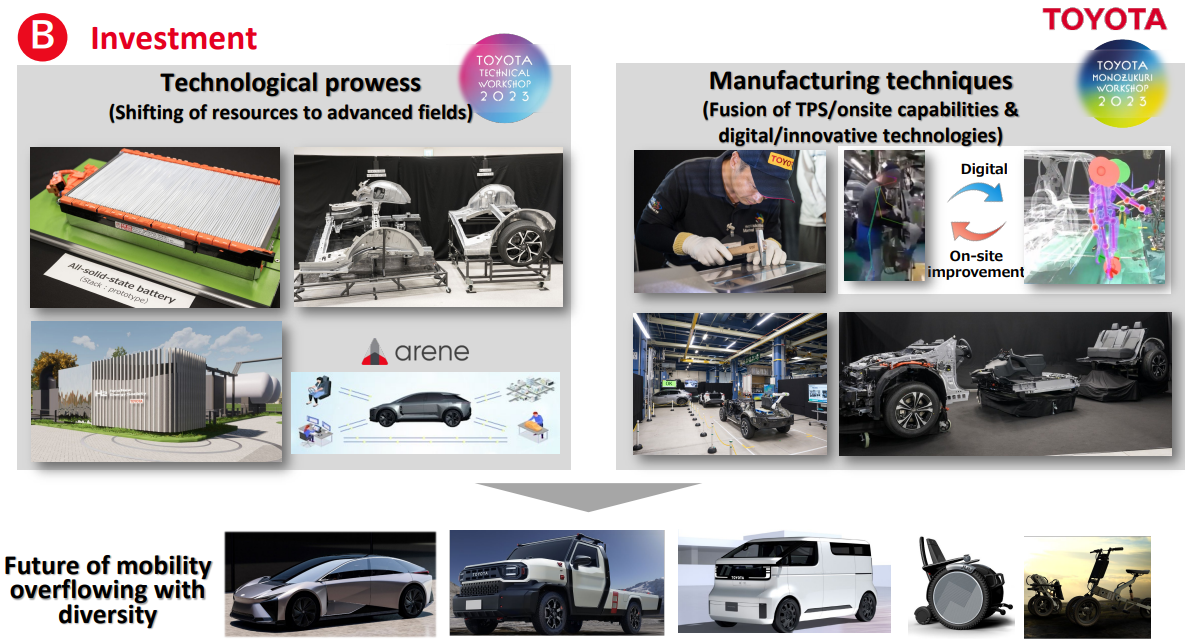

As a sign of Toyota’s commitment to compete in this rapidly-maturing electric vehicle space, the company also recently announced an additional US$8bn investment into its electric vehicle battery manufacturing plant in the US. This lends credence to their desire to transition into battery electric vehicles rather than the hybrid models they have been focusing on.

One key research development which can propel them to compete with the incumbents is the capability of their solid-state batteries. The company already has the ambition to begin this new generation solid-state batteries production in the next five years, offering a charging time of below ten minutes potentially with a range of 1,200km. Capitalising on this technology breakthrough will require flawless execution, with Toyota citing that a major challenge is the stacking process during the assembly where speed and precision is critical.

Even though the electric vehicle race has long begun, the potential of this transition from internal combustion engines remains vastly untapped. Missing out on the first mover advantage may not be that costly in this case, as Toyota certainly has the resources and scale to jostle in this competitive space and emerge as a worthy contender.