With the increase in interest rates globally, cracks are starting to surface in commercial real estate. Real Estate Investment Trusts (REITs) have been key to Singapore’s capital markets, and in the last couple of years, there have been more REITs seeking overseas assets. A result of this trend is that there are now numerous Singapore-listed REITs holding portfolio assets which are purely overseas such as Prime US REIT. And a key difference between those onshore and offshore Singapore REITs is the REIT structure which can have impact on withholding taxes and shareholding limits.

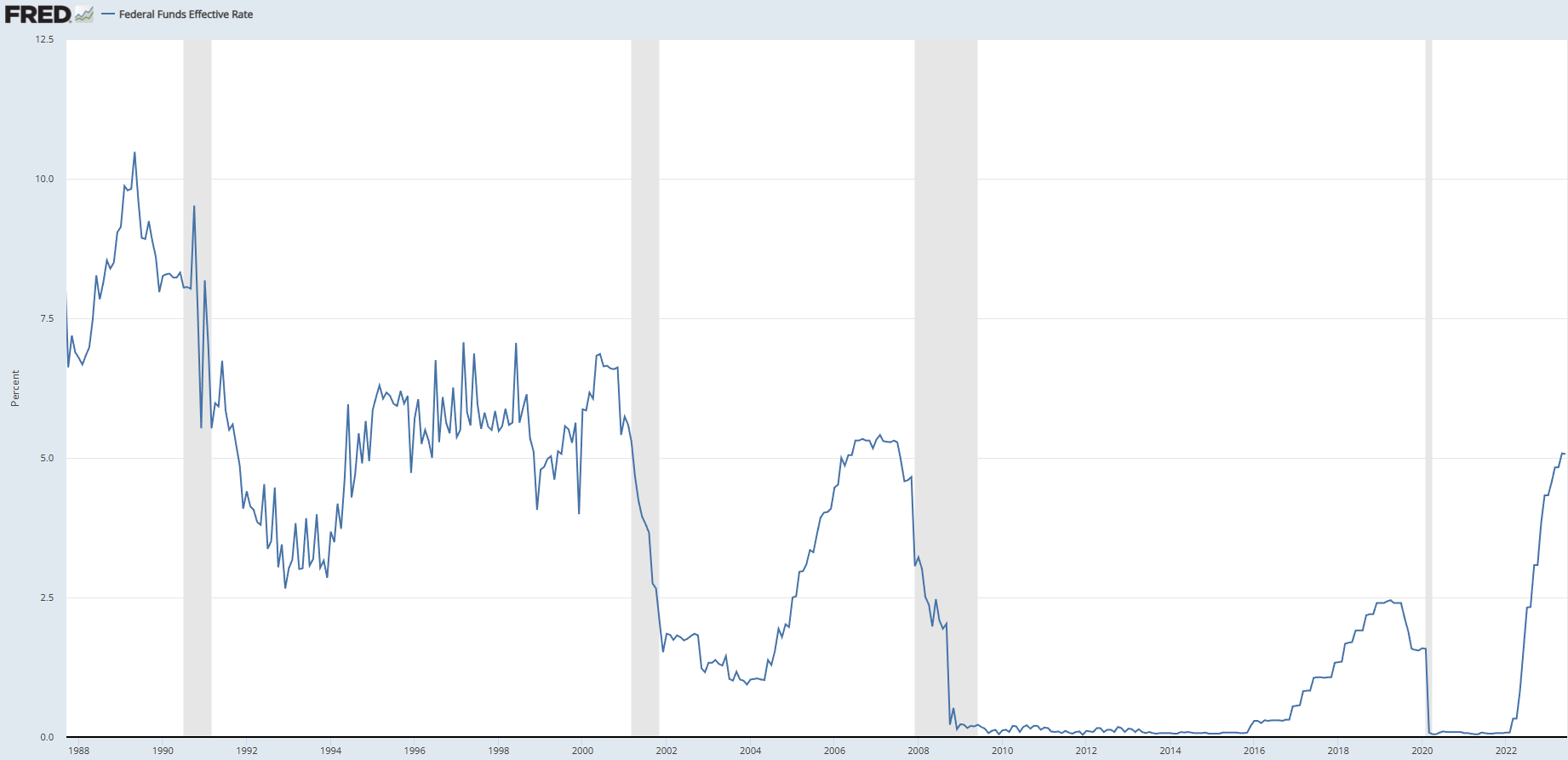

Lately, the challenging leasing environment in US office markets as well as late cycle elevated gearing are starting to strain even the more established REITs. One of the pioneer US REIT listed there is Manulife US REIT. Many of those Singapore-listed US REITs came into public markets around 2016 to 2019, capitalising on investor appetite for income yield. Since then, benign interest rate environment and tightening cap rates had led to an industry-wide acquisition spree. In addition, the pandemic years saw policy relaxation; in the form of statutory gearing limit being raised from 45% to 50% and deferment of minimum interest coverage ratio implementation.

As the global economy entered 2023, the goldilocks environment has reversed and central banks have already embarked on a series of interest rate hikes. Broad decline in portfolio asset value and higher financing costs exacerbated the deterioration in the REITs’ credit and asset quality.

Prime US REIT is a victim of the aggressive sell-off in the industry. The REIT is now trading at a 72% discount to its book value, with its last reported net asset value of US$0.72 per unit as of December 2022. As of writing, they own 14 freehold office properties across the United States and has assets under management of US$1.5bn. There will have to be more than 10% of portfolio valuation decline for their aggregate leverage to cross the 50% threshold. While not impossible, that will translate to about a net asset value of US$0.60 per unit. With shares trading at US$0.20 apiece, we are looking at a 67% discount in equity value even in that scenario.

To mitigate current challenges, asset divestment is one way to unlock value and narrow the valuation discount embedded in these REITs’ share prices. However, dispositions can be less than ideal in this market condition since the pool of buyers is not readily available and market transactions have dried up. Cash conservation is key and it will not be a surprise if we see a rush towards equity fundraisings when early signs of risk appetite return. Prime US REIT is certainly interesting at this distressed level, provided that the REIT manager makes strengthening the balance sheet a key priority.

Across the three Singapore-listed US office REITs (Manulife US REIT, Keppel Pacific Oak US REIT and Prime US REIT), timely resolution is most necessary for Manulife US REIT and Prime US REIT to shore up investor confidence.

The lapse of deal exclusivity with Mirae and early termination of lease from its fifth largest tenant has weighed on Manulife US REIT, at a time when they also require cash to reposition some of their buildings and offer leasing incentives for new prospective tenants.

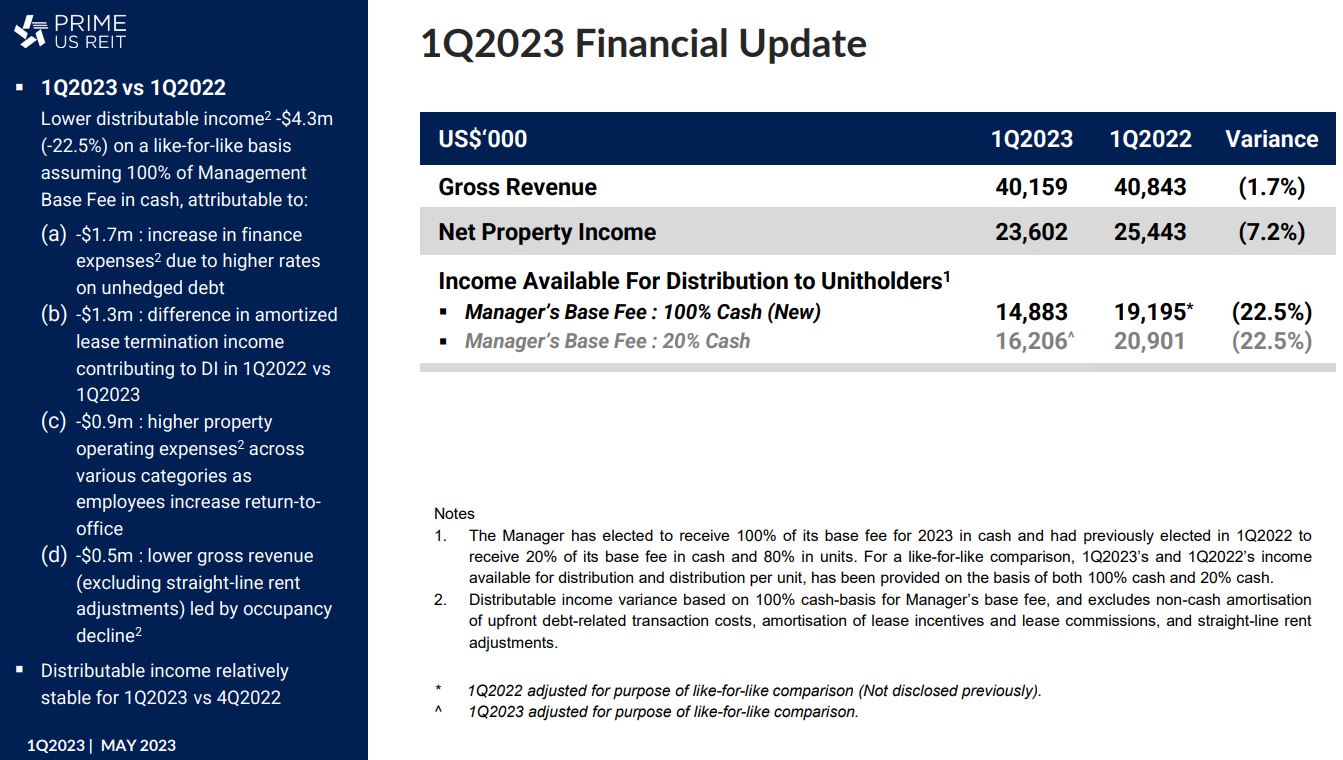

As for Prime US REIT, the manager recently announced their intention to receive base fees in 100% cash, instead of the case of 20% in cash and 80% in units for the previous year. Election to receive fees in cash will lead to less conservation of cash within the REIT, at a time when the operating and financing environment may get more challenging.

Therefore, in the face of these risks, the affected REITs will have to contend with mitigating any potential bad optics or negative perception arising from market jitters. It is not impossible, though, to balance these concerns; we believe that the REITs that manage to stay afloat and emerge from this period stand a good chance to ride up the next asset cycle.