Thai Beverage is predominantly a spirits and beer company in Thailand and Vietnam. With more than 1 billion litres of beer sales volume and 340 million litres of spirits sales volume in the first half of 2024, Thai Beverage is very much plugged into both the local and tourist consumption demand in these emerging economies. Spirits is the more profitable segment for the company, contributing to 64% of EBITDA compared to beer making up 28% of EBITDA despite both categories grossing similar level of revenue.

The past year had seen several industry headwinds such as higher input costs and the enforcement of Driving Under Influence (“DUI”) in Vietnam, affecting the sales of beer in domestic Thailand as well as Vietnam through the 53% stake they own in SABECO. However, green shoots are appearing as the cyclical recovery laps the trough of 2023.

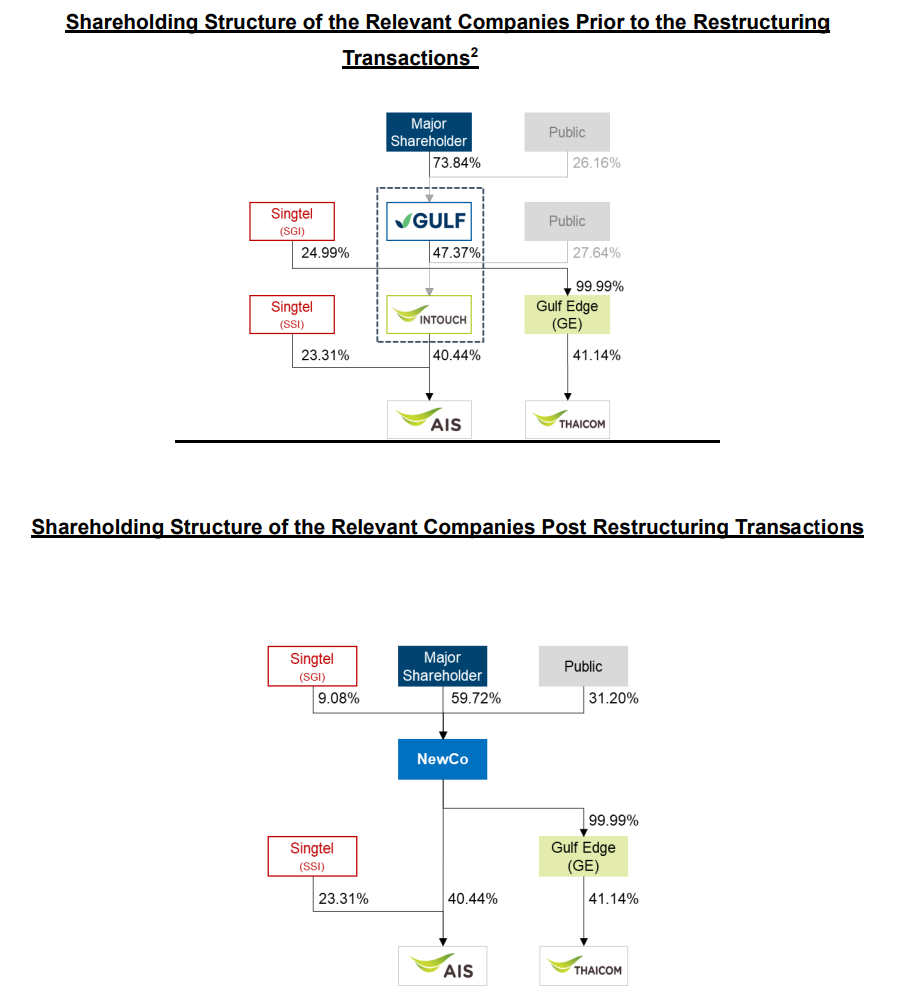

More interestingly, some Thailand companies are looking at further reorganisation of their entities recently. Take Intouch for example. Advanced Info Service (“AIS”), one of the main telecommunication companies in Thailand, is held through Intouch as an intermediary holdco. Gulf Energy Development, a major shareholder of Intouch, will simplify the shareholding structure of AIS by removing the indirect ownership layer via Intouch.

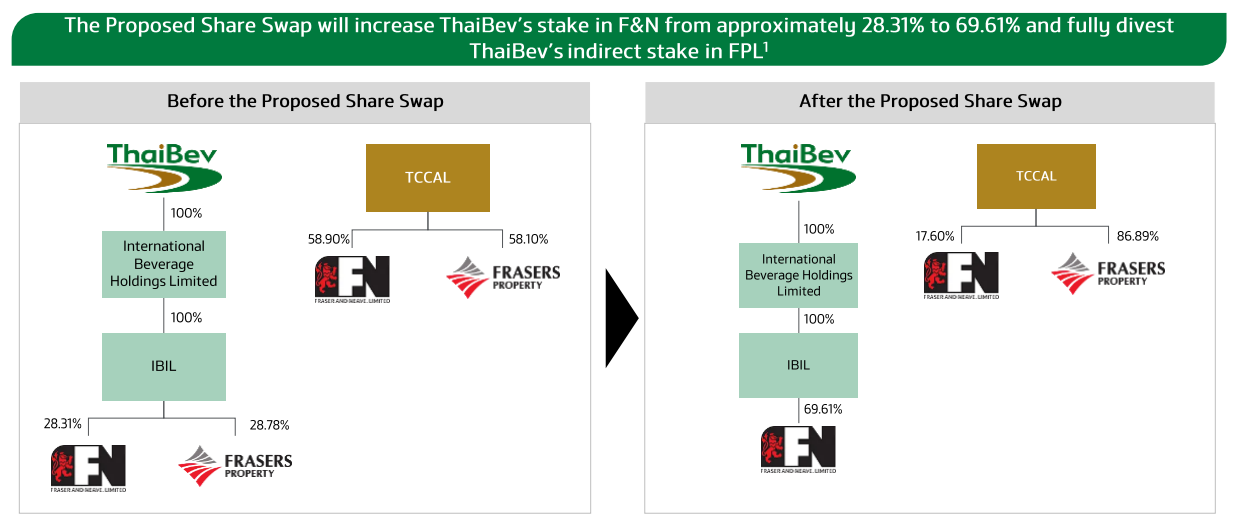

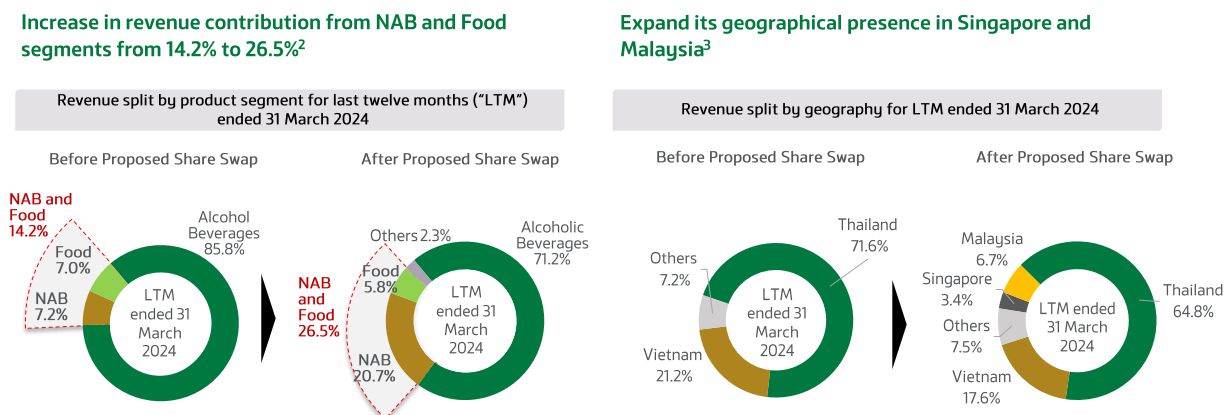

As for Thai Beverage, they themselves have announced a share swap agreement with TCC Assets to streamline their individual business verticals. Thai Beverage will swap their shares in Frasers Property in exchange for the shares in Fraser and Neave (“F&N”) owned by TCC Assets. As a result, Thai Beverage will be able to consolidate F&N’s food and beverage business to complement its own related businesses. At the same time, the property business of Frasers Property (unrelated to Thai Beverage’s core food and beverage business) will be transferred to TCC Assets.

Upon completion of the share swap transaction, Thai Beverage will emerge stronger as a pure-play on Southeast Asia consumption. Apart from its existing businesses in Thailand and Vietnam, the company’s geographical exposure will be expanded to include Malaysia and Singapore. In terms of product offerings, there will also be a greater proportion of non-alcoholic beverages.

Naturally, with Thai Beverage’s recent intention to delist Sermsuk from the Stock Exchange of Thailand for THB 63 per share ongoing as well as the completed delisting of Oishi in late 2023, markets may question if Thai Beverage is eventually also going to delist F&N. To that end, the company has commented that they are not looking to do so at this juncture although the delisting door remains open.

The enlarged Thai Beverage portfolio will comprise of market-leading brands such as Chang beer, Bia Saigon as well as 100 Plus and NutriSoy. This places the company amongst the ranks of the largest regional peers like San Miguel in Philippines and Masan Group in Vietnam. Taken together, these companies cater to a burgeoning class of consumers who may see rising disposable income as the emerging economies outpace the growth in developed markets.