On the last Thursday of February 2023, a lesser-known short seller was catapulted into the limelight for its scathing report on a titan in the power equipment industry. Muddy Waters Research, a well-known research outfit, boosted the reach of the short report by Jehoshaphat Research. The entity under attack was Techtronic, a Hong Kong-listed company with annual sales of US$13 billion employing nearly 45,000 employees as of the end of 2022.

Techtronic is a global leader in power tools such as their Milwaukee and Ryobi brands, competing in the same space as US-listed Stanley Black & Decker and Japan-listed Makita. Techtronic was valued at a market capitalization of US$23 billion weeks before the attack by Jehoshaphat Research.

One of the main allegations behind the short report was the use of accounting tricks, resulting in the company's ever-improving gross margins through a decade. Some ways for achieving that were purported to be based on capitalising business expenses, inflating assets (only to be written down aggressively later) and expanding inventory through overproduction of their goods. Accordingly, Techtronic will be highly challenged in this environment as they embark on a costly inventory reduction exercise. That said, with this being a one-sided account from the short-seller, it is only fair to also look the other way for possible counter points to those allegations.

A key long-term thesis for Techtronic has been their innovation over multiple product cycles, educating and penetrating the existing tools market with their lithium cordless battery technology. They have also developed an aftermarket battery ecosystem for their products, allowing them to pursue further margin expansion. Over the years, both their Milwaukee brand and the batteries segment have grown to drive the improvement in margin profile as the business revenue mix shifted towards these products. For context, the Milwaukee segment went from a 19% proportion of sales a decade ago to above 50% contribution to sales.

With regard to the excessive capitalisation of research and development costs, it may be important to take a step back and revisit the scale of these expenses in relation to the company’s sales. Based on published figures for the year 2022, product design and development investments amounted to US$484 million. The Group turnover for the same period was US$13.3 billion, translating to R&D being only 3.7% of sales. Total capital expenditures, including maintenance capex, are also at a reasonable 4.4% of sales.

At the same time, Jehoshaphat Research highlighted that in 2021, Techtronic disposed of their Property, Plant and Equipment at a 95% markdown. While that may sound large, the loss was US$33 million in magnitude. Putting it into perspective, net profit for that year of 2021 was more than US$1 billion. Moreover, a reason for the large markdowns stemmed from the defensive measure of selling their moulds and tooling assets for scrap metal (which fetched lower prices than otherwise). Reselling these in the open market is hardly an option since this may result in a loss of intellectual property as these assets were essential to the product innovation process at the company.

Another critical contention from Jehoshaphat was the bloated inventory and future impact on gross margin. It is true that inventory level has exploded after 2017, more than tripling from US$1.5 billion to US$5 billion at the end of 2022. There is soundness to this claim. The inventory overhang is likely to persist, given that not only have peers sounded warning on the industry inventory levels, but Home Depot (important customer of Techtronic) is also reeling from slower sell-through.

In general, inventory management is highly dependent on business models, forming part of the broader sales strategy and supply chain management of companies. However, in the current environment of slowing economic growth and waning consumer demand, the ability to draw down on inventory is certainly at risk. As a result, margin pressure is a valid point and something the management has to navigate to sustain the sales momentum.

From an angle of valuation, as an industry titan grossing US$13 billion in annual sales (while still expanding into new verticals), it is probable for sales to grow at a compound annual growth rate of mid to high-single digits. If we pencil in slower margin expansion in the range of 30 basis points and holding cost structure steady thereafter, operating profit margin may land at 9%. Accounting for lesser cash needs for working capital and a stabilised capital expenditure of 4% of sales, Techtronic may be able to generate upwards of US$750 million free cash flow annually on average over the coming years. At current enterprise value of almost US$21 billion, it translates to a tidy free cash flow yield of 3.5% (and growing).

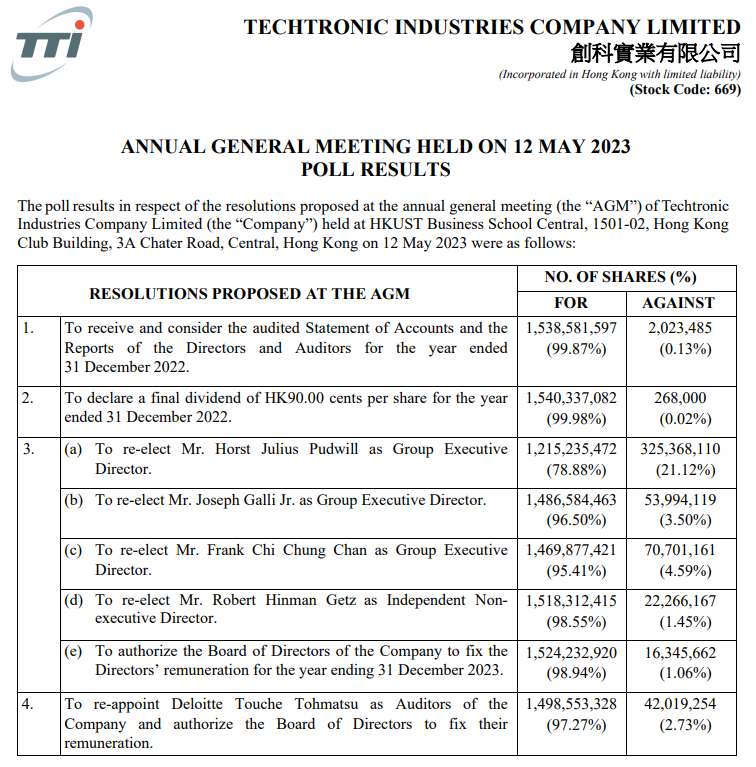

Looking back, this short seller attack wiped out US$4 billion of equity value from Techtronic, ranking amongst one of the largest in recent memory for the Hong Kong markets. Perhaps reflecting the frustration of investors, some shareholders voted against the re-election of the Chairman of the Board during the Annual General Meeting last week on the 12th of May 2023. The resolutions to approve the amendments to both the Share Award Scheme and Share Option Scheme were also barely passed.

Pressure is on for the management team to not only steer Techtronic out of these choppy waters but also allow its operational performance to serve as vindication of the business’s superior quality.