With the return of Huawei, the smartphone industry received a healthy dose of competition. For quite a while now, the high-end mobile phones have not been seeing much of a specification upgrade cycle. The industry has certainly matured rapidly over the last decade, and there is a physical limit to how many camera lens one can fit onto a phone. At the same time, there has not been much technological breakthrough on the hardware side of the smartphone, and only now do we see a little more commercial investments dedicated to foldable phones.

A direct consequence of this muted advancement thus far can be felt on component makers like Sunny Optical. Lacking the race for smartphone manufacturers to compete on hardware specifications and coupled with lengthening upgrade cycle for consumers, pricing power of these suppliers have eroded in the past few years.

However, for the last few months, there has been renewed optimism that smartphones volume is picking up and we may once again see a return of spec upgrades in smartphones.

For the most part of 2023, spec upgrades have focused on phone memory given that memory prices had come off quite substantially due to supply demand dynamics. A refocus on camera performance will certainly include newer adoptions like the periscope lens technology and 1-inch image sensor. These will be features of mid-to-high-end handsets, so it will not be surprising that Huawei will trigger a new round of performance competition among other players like Apple and Samsung. At the same time, Honor, Oppo and Vivo are also increasingly becoming strong contenders seeking to grab higher market share from incumbents.

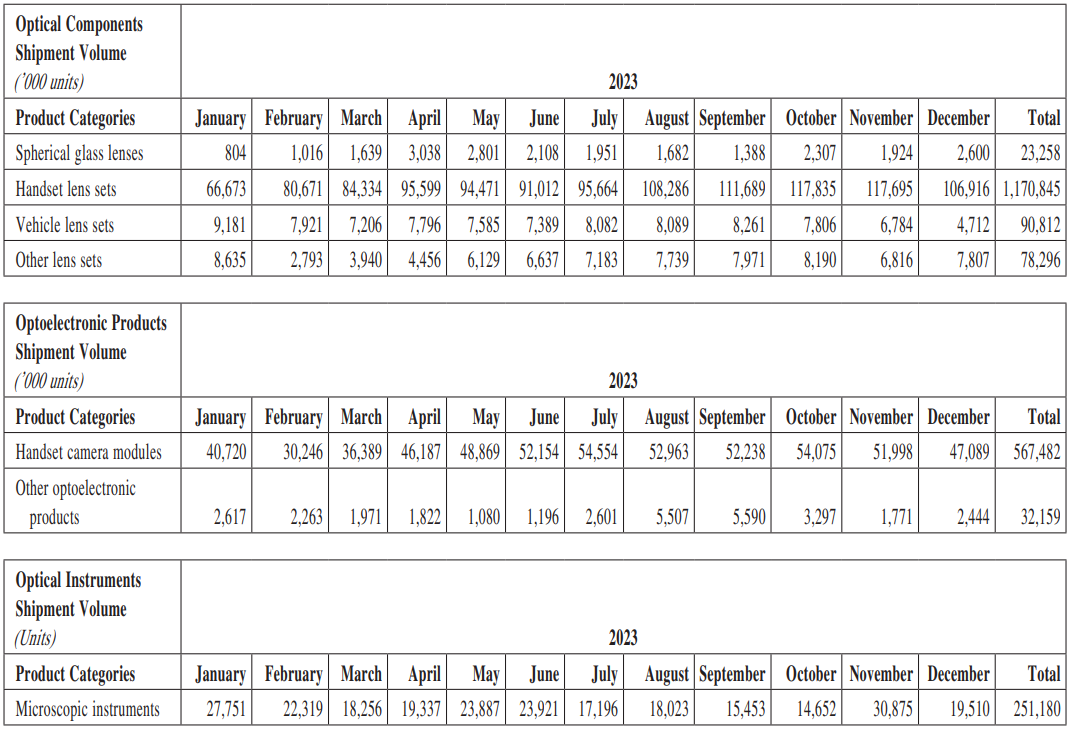

As competition among smartphone original equipment manufacturers (OEMs) heat up, that can only bode well for component makers. Average selling prices can rise for Sunny Optical, improving the margin profile for them after being subjected to a prolonged period of challenging operating environment. The December shipment statistics for Sunny Optical continues to point towards better days ahead for the company, with handset lens up 48% YoY and camera modules up 28% YoY. Continuing this trend, January shipment statistics released a few days ago pointed to an even stronger 55% YoY growth for handset lens and 53% YoY growth for camera modules.

A combination of consumer excitement as well as higher content value is likely to shore up investor confidence in the sector. With lower inventory build-up and short lead time, component makers may be able to ride the pricing benefits of a demand recovery. Towards this end, the technical know-how in periscope technology as well as latest adaptation of miniaturised cameras for foldable smartphones will position Sunny Optical to be the go-to supplier for many of the largest OEMs launching high-end models.