Spark New Zealand: Caught in a cyclical rut

Spark's financial guidance was reduced in light of the challenging operating outlook. Investors were clearly disappointed with the outcome, sending the stock down 20% post the earnings release.

The telecommunication company is currently caught in a rut, with their market value halving from one year ago. A new Chief Financial Officer was also appointed back in December 2024, but that is not enough to arrest the share price decline of the company in the latest first half results announced on 21st February 2025. EBITDAI (earnings before finance income and expense, income tax, depreciation, amortisation and net investment income) guidance was reduced in light of the challenging outlook in a recessionary environment. Investors were clearly disappointed with the outcome, sending the stock down 20% post the earnings release.

Spark is a market leader in New Zealand, offering communication services such as mobile, broadband, cloud and other digital solutions to customers from individuals to households, corporates and government. More specifically, it is the Enterprise and Government division which weighed on its operations, given the reduced budgets from these customers to spend on Spark’s products and services. In addition, on the consumer front, aggressive price competition in mobile has led to further headwinds in the short-term.

In response to the pressure faced by management in the past few quarters, the company is undergoing a business rationalisation plan (SPK-26 Operate programme) to target cost savings of up to $100m in full-year fiscal 2025. In an effort to streamline the business and pivot away from non-core operations, Spark completed the sale of its mobile tower infrastructure business called Connexa, with the last remaining 17% stake in Connexa sold in end February for $311 million. The net proceeds (eventual gain on sale of $69min reported EBITDAI) will be a positive step towards asset monetisation and help Spark refocus on its current growth strategy.

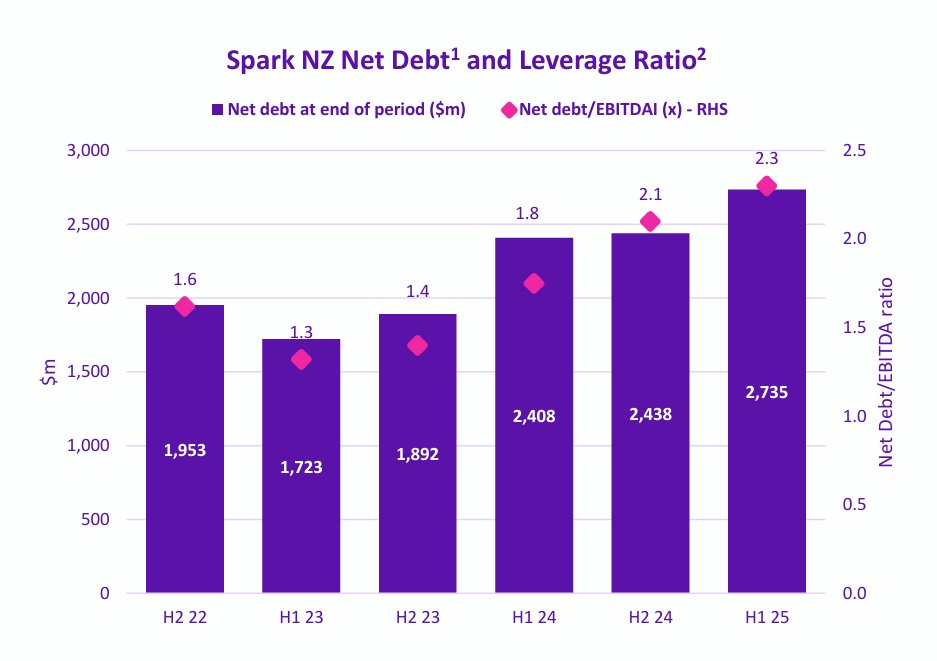

The company needs to quickly adapt to the changing operating landscape, and has thus far identified data centres as a key potential theme. An expression of interest process has been initiated to attract prospective capital partners on this investment venture but no details are finalised as yet. Spark intends to spend about $425 million in capital expenditure for FY25, underpinning its commitment to continually invest in their business priorities. At the same time, management has to allay debt concerns which led to its issuer credit rating of A- Stable being placed on negative outlook/watch by credit rating agency S&P Global Ratings.

According to an Accenture report jointly released with Microsoft in 2024, Generative AI can contribute material growth to New Zealand’s economic activity, with productivity gains potentially amount to 15% of the country’s GDP by the next decade or so. To spearhead these efforts, Spark is integral in the underlying digital infrastructure, with the opportunity to cement its market leadership not just in mobile services but also the enterprise IT systems. In particular, the country’s domestic network infrastructure, complemented with quality access to global subsea cable infrastructure, has the capacity to support increased network traffic from the data demand of AI.

In this respect, if stakeholders are willing to take a longer-term view of the vast opportunity of widespread digital adoption, Spark remains structurally well-positioned to capture the value created from an AI-enabled ecosystem and regains its sparkle.