Alimentation Couche-Tard has launched a friendly offer for Tokyo-listed Seven & i Holdings, which has been confirmed by the company on 19 August 2024. With this acquisition proposal, Seven & i has convened a special committee to review all the potential options for the company. With the equity valuation of Seven & i now approaching US$40bn, a deal will likely be the largest foreign takeover in Japan’s corporate history.

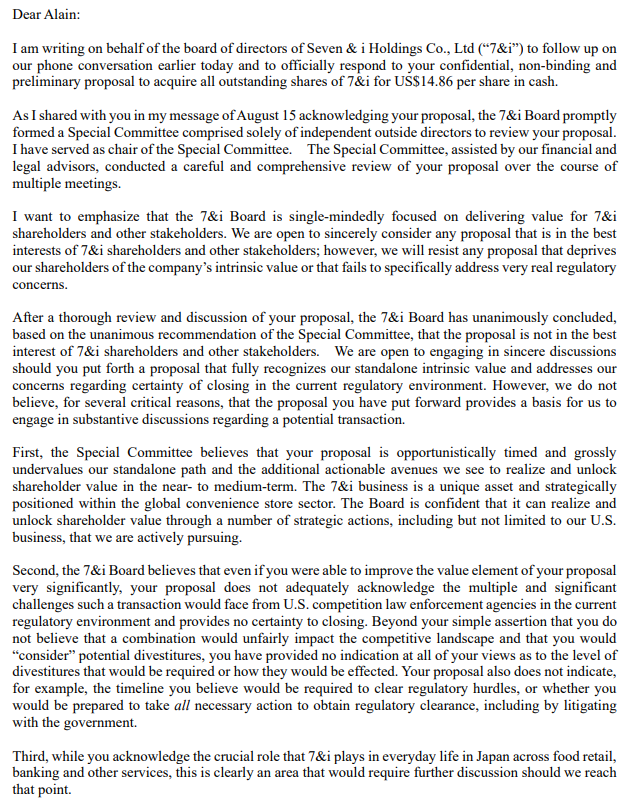

Three weeks on, Seven & i’s special committee has made public a letter responding to Alimentation Couche-Tard offer. In the letter, the company stated its willingness to consider any proposal and likely further negotiate in good faith. However, the initial price of US$14.86/share cash offer will be rejected on the grounds of undervaluing the company as well as not addressing regulatory hurdles comprehensively enough. On the end of Alimentation Couche-Tard, management has reiterated their interest and confidence in financing this potential deal.

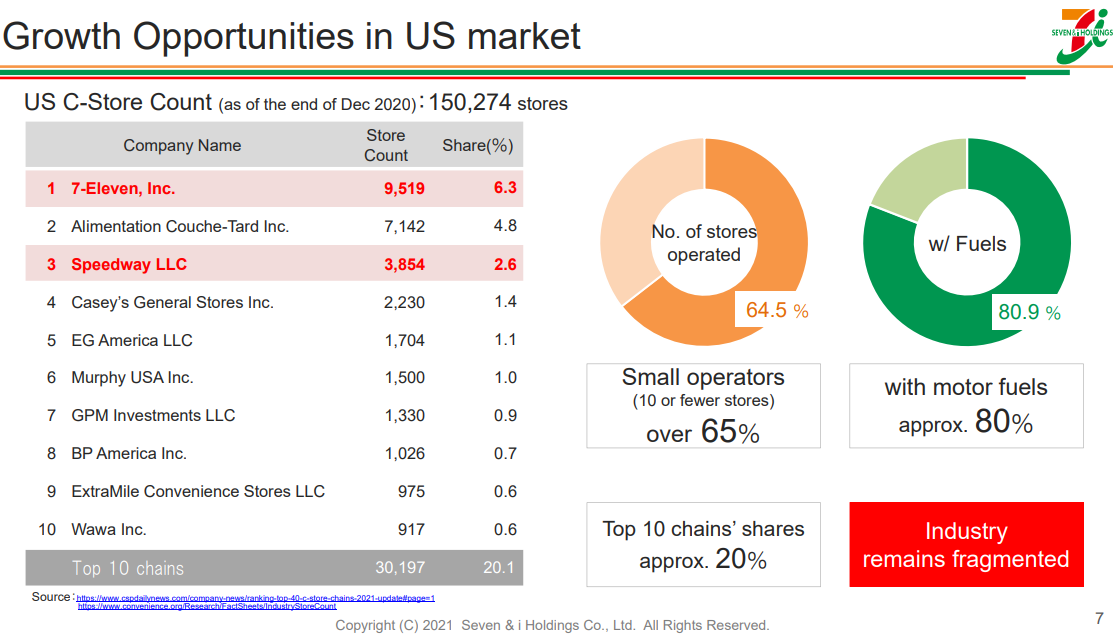

For the past few years, Seven & i themselves have been active in their own dealmaking. Partly due to shareholder activism and Japan’s push for corporate governance reforms, Seven & i went ahead with divesting it’s Sogo & Seibu department store business, rationalized the retail footprint of its Ito-Yokado supermarkets and harbors the intention to spin off that portion of the superstore operation in the coming years. In this same period, Seven & i reinvested in their core US business, edging out Alimentation Couche-Tard in its bid to acquire US-based Speedway for US$21bn in 2021.

For any successful transaction to materialize between Alimentation Couche-Tard and Seven & i, there are several hurdles to cross. For a start, multiple important stakeholders have to be convinced amidst the conservative Japanese board culture. While there is positive progress on the independence of the board and presence of activist investors like Third Point and ValueAct Capital, nearly 10% of Seven & i Holdings is still ultimately owned by the Ito family.

Having known the late Masatoshi Ito personally, Alimentation Couch-Tard’s Alain Bouchard has approached to express interest in Seven & i three times. The first was in 2005 when both companies were still growing their presence in the US, and the second time was in 2020 according to Nikkei Asia. None of those instances were hostile bids, so it is unlikely for both parties to turn this current acquisition proposal into a poison pill situation.

That said, Seven & i was mentioned to be applying to the Japan authorities for the company to be classified as a ‘core’ business under the Foreign Exchange and Foreign Trade Act. This will require any investor to file a notification if they own more than 10% shareholding level and want to purchase more shares. A latest comment from a senior finance ministry official in Japan pushed back on the use of the Act to protect against foreign takeovers, further clarifying that an entity classification does not affect the degree of scrutiny in a national security review.

The reason why Seven & i operates ‘designated’ businesses under the Foreign Exchange and Foreign Trade Act in the first place is due to the essential services the convenience store operator provides in Japan. The concept of ‘Konbini’ is very much embedded in Japan local community, with the convenience stores allowing the locals to pay bills, process government administrative work and withdraw cash from ATMs. Given its wide network and round-the-clock operations, the convenience stores are also involved in natural disaster response and recovery efforts such as for the supply of food and water to citizens.

There may also be antitrust reviews elsewhere, primarily in the US as a deal will mean that the top two convenience store operators in the market will consolidate market share. Seven & i’s deal for Speedway in 2021 already led to the market leader purchasing the third-biggest player, while Alimentation Couch-Tard was the second biggest at that time. Now, a combination of Seven & i’s US convenience store network with Alimentation Couche-Tard’s own network will form an even larger market leader by far, with some putting the estimate at about 12% total market share. The next biggest player will only command about 2% market share.

Therefore, Seven & i indeed pointed out several key hurdles which may not lead to a successful deal closure in their latest Board letter to Alimentation Couche-Tard. Many market observers are looking at the progress of this potential deal as an indication of the extent Japan is actually opening up to foreign investors to become more business-friendly. Beyond that, there is no doubt that Japan as a country is now on the radar of investors worldwide, having receive growing interest as an inbound investment destination spurred by the weak yen currency in recent years.