Born out of a merger between Singapore juggernauts Keppel Offshore & Marine and Sembcorp Marine in 2022, Seatrium is now a larger combined business focusing on the global offshore, marine and energy industries. This allows Seatrium to compete effectively in the world stage, against other peers such as the Chinese and Korean shipyards.

Despite being quite a complex transaction (and later on revised to a simpler structure), the S$4.5b deal was completed in 2023 to form an enlarged key global offshore and marine player. Yet over the next few quarters, Seatrium was entangled in a series of hiccups, from investigations of its Brazil operations to earnings impact from provisioning for legal arbitration.

With that said, the loss-making years of Seatrium may finally be behind them as they complete their legacy projects. Markets are also taking comfort in the fact that the company, in a show of confidence with the business, is utilizing its cash to conduct share buybacks. A S$100m share buyback program was announced in April 2024, and their buyback activity has been active in the past two months. Nearly 15 million shares amounting to 0.44% of issued shares have been bought back since the approval of the buyback program.

Weighed down by prior cost overruns in part due to the pandemic and resulting inflationary pressures, Seatrium is now executing on a profit turnaround strategy. Leveraging on its technical know-how and expertise in more complex projects, the company has been able to maintain its order wins momentum and is confident of achieving better gross margins than the previous legacy projects. With the 1H24 results being back in the black, Seatrium is finally on track to posting a positive net profit after a likely period of investor disappointment.

Looking forward, with its net order book of S$26b (half of it won in 1H24 alone), management has set its sight on their 2028 financial targets of more than S$1b in EBITDA, at least 8% return on equity and around two to three times of net debt to EBITDA. For that to happen, there need to be not only top line growth, but also cost discipline to translate to a more substantial EBITDA. To complement the operational strategy, asset base rationalization is also being considered to boost profitability and return on equity.

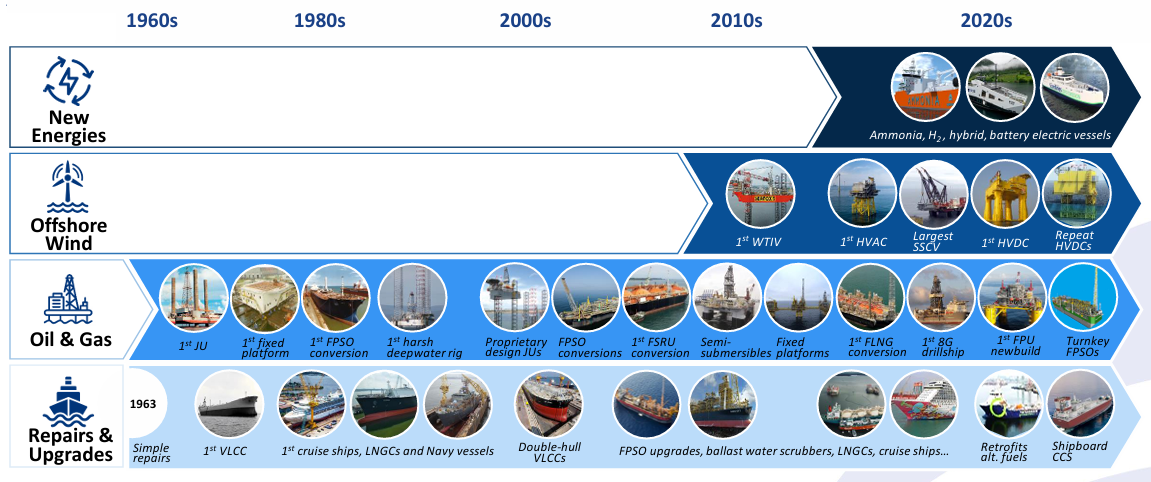

Apart from the more traditional oil and gas business, Seatrium is also making inroads into renewables and new energies. While offshore wind is one of the earliest to be commercialized, there are newer energy ventures like ammonia and hydrogen technology in the pipeline.

Having already established a strong track record in offshore wind via their fixed substations and wind installation vessels, the company is also keen in positioning itself in the space of liquid hydrogen-powered ferries and battery electric vessels. These efforts will help to future-proof Seatrium's portfolio and capabilities in order to maintain its world-class expertise and stay ahead of the innovation curve.