Sea Ltd: Can Shopee regain its footing against TikTok?

The emergence of competitive threat from TikTok has led to incumbents like Sea’s Shopee and GoTo’s Tokopedia reinvesting resources to defend their market share.

Among the numerous tech unicorns minted within Southeast Asia, a central theme revolves around businesses catering to the populous cities with their young demographics. Platform companies providing services tend to dominate this space, with the likes of Sea, Grab, GoTo and VNG. However, recently in the e-commerce landscape, the emergence of competitive threat from TikTok has led to incumbents like Sea’s Shopee and GoTo’s Tokopedia reinvesting resources to defend their market share.

In the heated market of Indonesia, it has resulted in a 75% stake sale of GoTo’s Tokopedia to TikTok in December 2023. The transaction enabled GoTo to deconsolidate the e-commerce operation while receiving variable revenues as a proportion of the gross transaction value. This move will allow the company to focus its resources on growing the fintech business instead. All of that will not bode too well for Sea Ltd, as it now competes with a bigger competitor with strong financial might.

While TikTok has yet to overtake Shopee’s penetration rate in Indonesia, they are likely to do so given that there is a strong network effect to generate traffic from TikTok’s social media platform into TikTok Shop. With TikTok achieving success in other Southeast Asian countries like Malaysia and Thailand, it will be a neck-to-neck battle for market share between Sea Ltd and Tokopedia-TikTok in Indonesia.

Zooming out of Indonesia and including Shopee’s stronghold in Taiwan and other ASEAN countries, the entire Shopee business is expected to turn EBITDA positive on an adjusted basis in the second half of 2024. This will be a strong boost to Sea Ltd from a cash flow perspective and allows them to maintain a competitive advantage through their cost base. In the event that TikTok steps up its aggressive expansion strategy, Sea Ltd will have more capacity to defend using their own marketing or promotional activities.

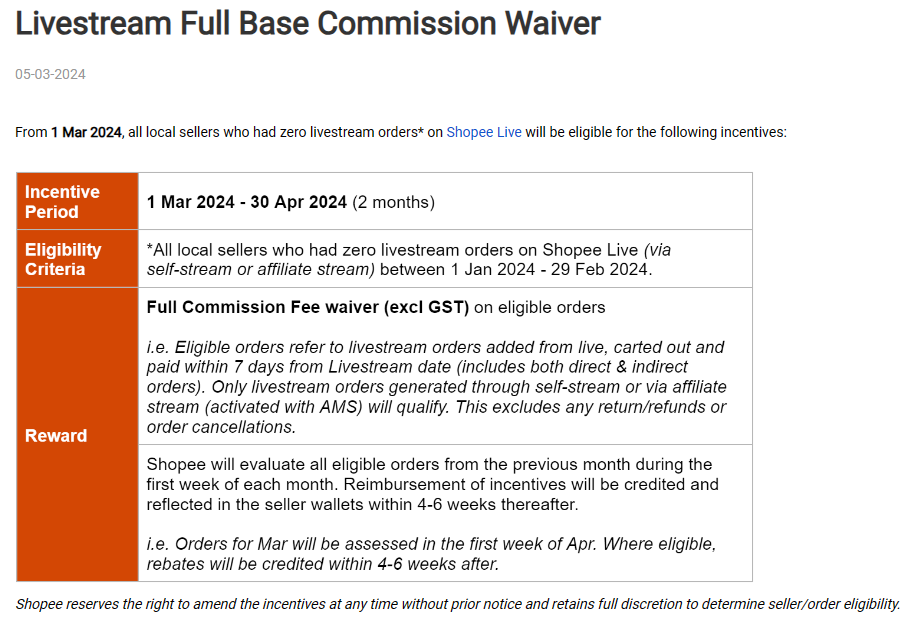

Another area which Sea Ltd is trying to cement Shopee’s e-commerce leadership in is on livestreaming. This strategy is not new, but it has varying success in different local markets. With the unit economics still low compared to the core marketplace, livestreaming has the potential to improve take-rates and drive further growth for Shopee. Alibaba-backed Lazada saw livestreaming took off during the pandemic but recent woes and layoffs may lead to them restructuring their e-commerce operations in the region. This is all despite additional investments from Alibaba just a few months back.

This presents an opportune time for Shopee to grow their video ecosystem and increase engagement level with their customers.

As part of its multi-pronged approach, the company is also exploring features such as more delivery options and expanding its buy-now-pay-later services. Shopee will debut an expanded return and refund policy in Singapore by the end of March 2024. The company’s buy-now-pay-later service called SPayLater may also be offered to offline merchants and the plan is currently in the works.

Taken together, Sea Ltd has shown its commitment to being an e-commerce powerhouse in Southeast Asia and to cater to this generation of young savvy consumers. More importantly, it is showing TikTok and other new entrants that they are nimble and responsive to any changes in the competitive landscape.