Earlier in April 2023, SATS completed its transformational deal of acquiring Worldwide Flight Services (“WFS”) for EUR1.3b. The combined scale of operation has placed Singapore-headquartered SATS on the world map, with presence in 27 countries across 210 locations. As a leading air cargo handling company, WFS will thus enable SATS to provide more connected aviation service solutions to their customers and capture value along a wider segment of the global trade supply chain.

Projected to realise synergies north of S$100m, SATS is looking to achieve operational efficiency by means of cross-selling and expansion via networks and partnerships. From a geographical perspective, this transaction allows an established Asia operator to immediately gain a foothold in Europe and North America. The enlarged entity will have the ability to compete neck and neck with other players like Swissport.

For the past two quarters, SATS’s core operations in terms of passengers, meals and flights handled all registered strong growth year-on-year. However, cargo tonnage saw a reduction over the same period. With the air travel industry rebounding but air cargo normalizing, SATS now have an immediate economic imperative to balance these two sides of its portfolio businesses. More emphasis will have to be put on optimizing the cargo business and defending the business margins in light of the soft air cargo volume.

Singapore state investor Temasek remains the substantial shareholder of SATS. To steer the company in the right direction, there has also been some management reshuffling as well as changes to the Board of Directors. Henry Low, previously the country manager of Amazon Singapore, was appointed the Chief Operating Officer of SATS and Tan Chee-Wei also came onboard from Shell to be SATS’s Chief Human Capital Officer.

These two key executive appointments will help smooth out the acquisition of WFS and manage the transition for the company. A new streamlined organisational structure saw the departure of WFS’s Group CEO, Craig Smyth, while the regional CEOs of WFS continue to lead their respective markets in EMEAA and Americas.

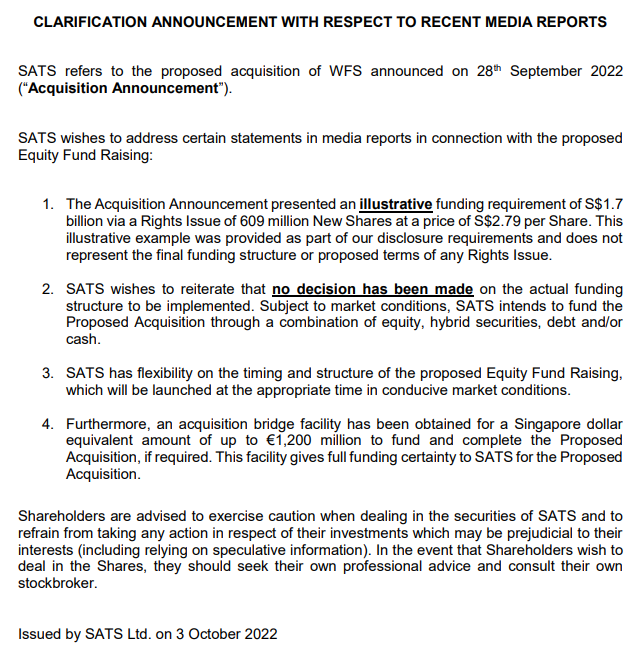

This is not to say that this transformation was not without challenges. Right from the onset, capital markets have had mixed responses to the rights issuance for funding the acquisition. In total, S$784m net proceeds were raised at a rights issue price that was about 20% discount to the last traded price before the announcement. A public statement was also issued to clarify concerns with the funding structure of the deal.

Now, with the rights issue behind them, it is an opportunity for SATS to demonstrate its execution abilities to digest the deal. They now have with them an asset like WFS to embark on its global expansion, keeping in mind that the deal may not even have closed if they have waited to pull the trigger as macroeconomic conditions (and deal-making sentiments) deteriorated further since then.