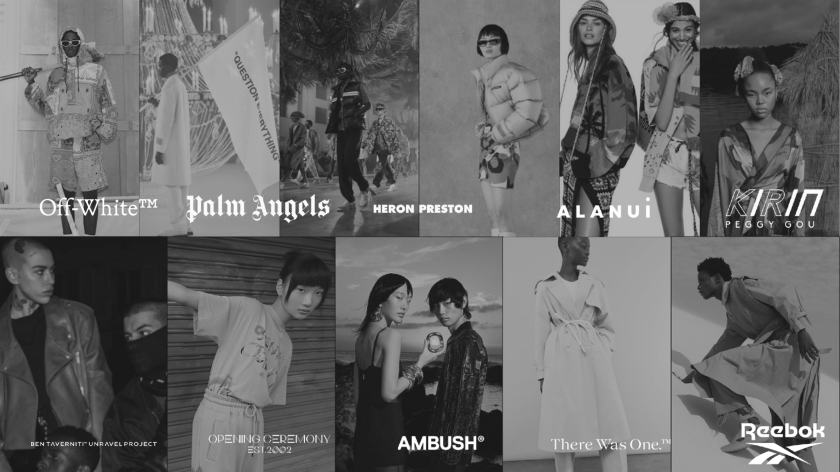

In the heart of Milan along Via Turati, a newly-assembled team is looking to reposition Reebok as the next luxury brand. This is likely the biggest, most immediate project for what is called NGGH++, a new growth platform under FARFETCH. The team will be responsible for transforming Reebok, leveraging their experience with brands like Off-White and Palm Angels.

Back in August 2021, Adidas announced the ownership sale of Reebok to Authentic Brands Group (ABG) and the deal was completed in March 2022. But as early as 2016, Reebok had already been undergoing a turnaround. It was not until early 2021 that a formal divestment process was considered for the brand. Fast forward to 2023, the brand will be driven by a long-term partnership between ABG and FARFETCH’s New Guards Group (NGG), focusing on content marketing and more.

As we write, this quarter of 2023 marks the start of efforts for Reebok’s strategy. Not only is NGG focusing on Reebok Europe, but they are also developing an international premium line known as Reebok Global Catalyst. The idea here is to break into the luxury segment through apparel and sneakers, hopefully filling the market rift left behind by the fallout of Ye’s Yeezy and Adidas as far as premium sneakers go.

To do this, they have brought on former Nike executive Cristiano Fagnani to lead this project and potentially drive sales between a target range of US$250-350 million for FARFETCH in 2023. In the longer term, Reebok business under FARFETCH is projected to roughly double to gross above US$600 million beyond 2025. This will no doubt involve creative collaboration with other iconic brands amidst an aggressive brand repositioning strategy.

Any success in the Reebok project will be a testament to both the depth and breadth of capabilities at FARFETCH. This may help to serve as a convincing case study for another growth market: China. Currently, FARFETCH already conducts both B2C and B2B businesses in China. What is interesting will be their B2B platform called CuriosityChina which they acquired in 2018. Any breakthrough in Reebok will not only make heads turn in the industry but also lend credence to their white-label solutions for global brands looking to enter China.

The luxury market in China speaks for itself through its growth and resiliency. Especially for FARFETCH, their Chinese customers are likely to have higher lifetime value given strong mobile engagement level and aspirations from the young affluent demography.

Taken together, the experimental nature of New Guards Group means that any brand success there will translate to a stronger resume material in pitches to FARFETCH clients. Not only will luxury brands be more willing to be onboarded to FARFETCH marketplaces, but it may also help to convince big luxury powerhouses to think about a broader B2B platform solution offered by FARFETCH for their brands.

Looking ahead, we are excited about their pipeline. It is in no small part due to the significance of deals such as the strategic partnership with Reebok and an arguably more complicated execution of Richemont’s YNAP.

The next three years will possibly be a show-me story for FARFETCH, and there is no doubt China will be a critical piece of the puzzle given their dominance in the global luxury landscape. A successful showcase of Reebok repositioning internationally, coupled with a demonstrated traction in China, will deliver a track record essential to FARFETCH's ambitions.