Pony.ai: An eventual path to driverless vehicles

As transportation and mobility moves towards Level 4 degree of autonomy, Pony.ai is a clear beneficiary with its leading track record of real-world testing.

Pony.ai has managed to take advantage of the year-end window of opportunity in the US to raise an upsized IPO offering priced at the top of the range. For a company which is less than a decade old, it wasted no time in developing its leading autonomous driving technology and accelerating its path to commercialisation. Pricing its shares at US$13/share, the company is currently trading at a market capitalisation of nearly US$5bn.

As transportation and mobility moves towards Level 4 degree of autonomy, Pony.ai is a clear beneficiary with its leading track record of real-world testing. As it stands, most adoptions are currently in Level 2 and 3, for which a driver is still required to take control when necessary. Without doubt, Chinese cities are at the forefront of this development, with fast-growing penetration of Advanced Driver Assistance Systems (“ADAS”) technology on the roads.

Pony.ai has licenses to operate robotaxis in all four Tier-1 cities, namely Beijing, Shanghai, Guangzhou and Shenzhen. In addition, its fully driverless license in Shenzhen covers the more complex downtown area and the company has begun fare-charging commercial operations in all the above-mentioned cities except Shanghai. This is in contrast to other players like WeRide and Baidu Apollo Go which may only be at the testing phase in Guangzhou, for example.

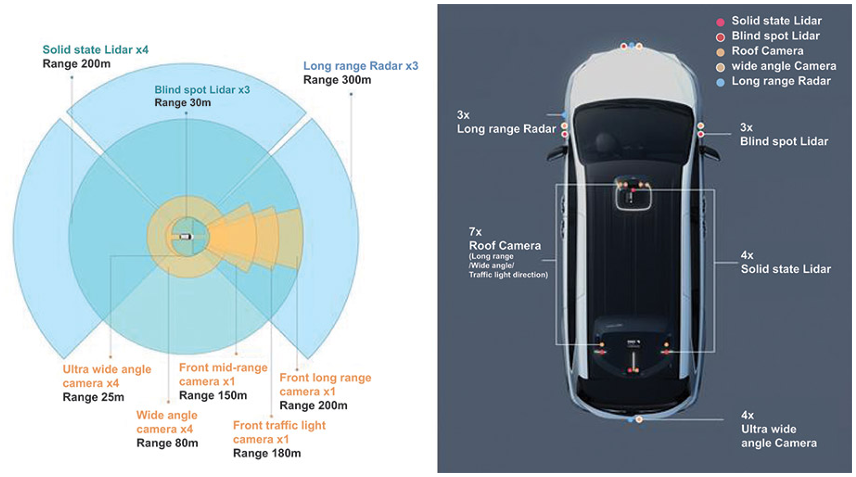

Honing in on Pony.ai businesses themselves, they are positioned in both the robotaxis and robotrucks space. These vehicles can be either owned by the company or belongs to a third-party fleet. At its current development trajectory, robotaxis technology are more mature and likely to be the more meaningful contributor to Pony.ai business in the near-term. As the company’s Virtual Driver technology gains more widespread recognition and integration, a wider fleet of vehicles utilizing Pony.ai self-driving technology will naturally further expand revenue opportunities.

In the early days, a longstanding industry collaboration with Toyota led to the Lexus RX 450h model being equipped with Pony.ai autonomous driving systems back in 2019. The partnership deepened to include several other models and newer generations of technology in the following years, such as the Toyota Sienna AM with the 6th-gen system in 2023.

With this latest form of proprietary full-stack Virtual Driver technology, it is vehicle-agnostic and thus opens up a whole array of partnership possibilities with both auto OEMs and transport network operators. The company is also expanding geographically, with several MOUs signed this year in Luxembourg and South Korea. With high profile investors funding the company, it is almost certain that Pony.ai will continually grow its presence in regions like the Middle East too.

To build upon its track record, it is more likely that the company will have to commit capital expenditure to grow its own fleet and fit them out with its own autonomous driving system in new markets. This means that an initial outlay is necessary in the ramp-up of its commercial phase before being able to achieve operational leverage from just the technology platform alone.

An improving unit economics with high utilization rate will be critical for Pony.ai to become profitable and self-sufficient without a constant need to tap the capital markets. The question then, is whether global investors have an appetite in the coming years to continue funding research and innovation such that Pony.ai can reach a critical mass of vehicle fleet employing its driverless technology.