While MTR is largely known to be the public transport operator for Hong Kong, its business goes beyond rail operations in Hong Kong and instead encompasses both property business and international railway segments.

In June 2024, the company announced the launch of the new sleeper train service connecting Hong Kong to Beijing and Shanghai, with the new high speed rail journey cutting travel times by half. This builds upon the network expansion plan of the high speed rail with regards to better cross-boundary connectivity with various China provinces.

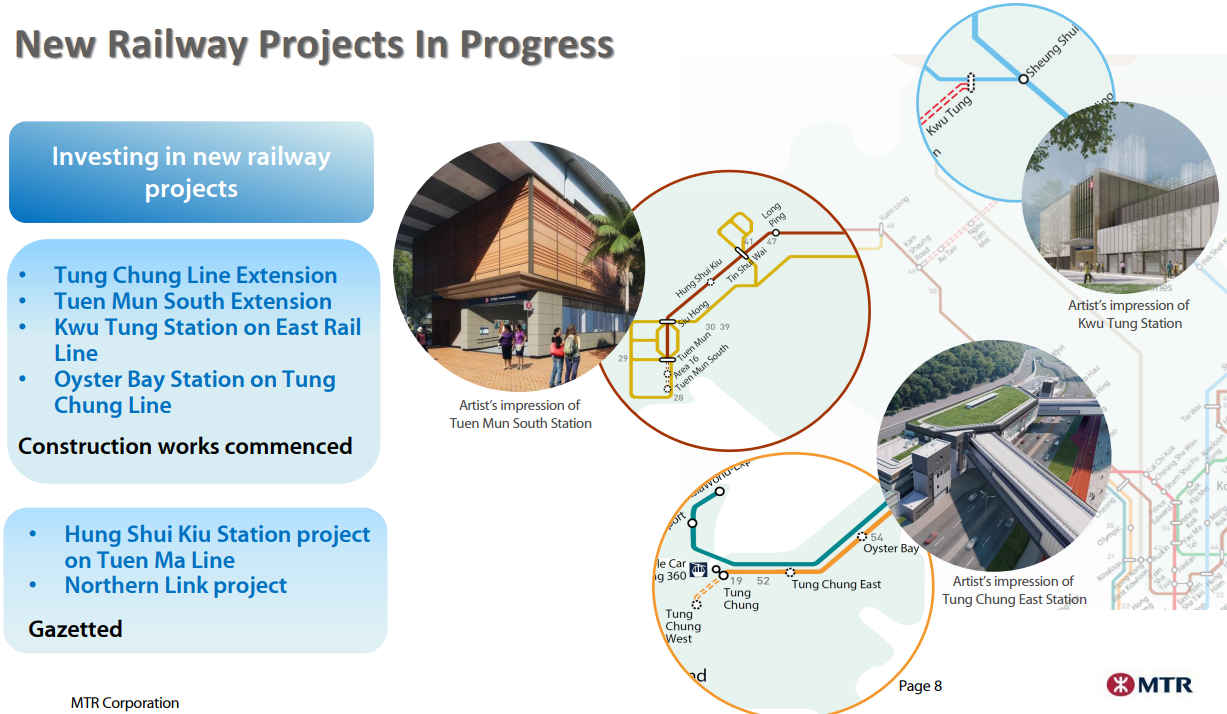

For MTR’s domestic light rail operations within Hong Kong, the company is also embarking on several projects such as the Tung Chung Line and Tuen Mun South Extension. As a display of innovation and future-readiness, they also recently took delivery of a new hydrogen-powered light rail train to be put into testing and trial runs in Tuen Mun.

The investment into these projects in the pipeline means that MTR is estimated to record about HK$30b in annual capital expenditure for the coming years. About half of the amount will be used for maintenance and renewal of Hong Kong’s railway, while another one-third budgeted for the new railway projects.

What is less understood about these projects is the business model. Since these infrastructure and transportation projects may not yield as much commercial returns, it is the creation of the rail-plus-property model between the government and MTR which allows for actual commercial viability.

The rail-plus-property model ensures that MTR can possess landbank around the rail stations it construct. Comprising both residential development projects and commercial malls, the property division helps to supplement the transport division by contributing to profits for the company. In 2023, the property rental and management segment contributed HK$4b of earnings before interest and tax. In addition, the trading income from property development recorded HK$2.3b in EBIT for MTR. This helped to compensate for the HK$1b EBIT loss from the domestic transport operations.

The property development business model begins with MTR being awarded a plot of land along the rail line. The company will then call for tender from developer partners such as Kerry Properties and New World. There are various profit models for these development projects, depending on the proportion of risk undertaken between MTR and the property developers.

A lump-sum upfront payment structure is essentially a land premium which developers pay to MTR after being awarded the tender. This means that if the property market goes into a downturn after that, MTR will largely be insulated from the market conditions, since most of the profit or loss will be borne by the developer partners. However, the reverse is true in a market upswing. MTR potential profits will be capped since most of the profits will accrue to the developer partners when these residential units are launched for sale during a market upturn.

Ultimately, the proportion of the lump-sum payment component vis-a-vis some form of profit-sharing mechanisms will determine when and to what extent MTR will make a return from the property development business. With Hong Kong real estate market going through a slump due to the high interest rate environment, markets should take solace in knowing that MTR has mainly lump-sum payment-based contracts currently.