Being in the business of managing most of the major airports in Malaysia, Malaysia Airports has recently received keen interest from international investors including private equity players. Since the announcement of a consortium-led privatization deal, attention has duly turned to the relevant authorities’ willingness to approve this aviation sector transaction.

Leading up to the deadline of 15 November 2024, the company has gotten the green light from the Turkish Competition Authority, Saudi Arabia’s General Authority for Competition as well as the Egyptian Competition Authority. More importantly, on 30 October 2024, the Malaysian Aviation Commission also issued a preliminary nod to the transaction.

To recapitulate, a pre-conditional voluntary offer was announced in May 2024 to acquire Malaysia Airports shares at an offer price of RM11.00 per share. The consortium comprises of existing shareholders of Malaysia Airports, namely Khazanah and the Employees Provident Fund, and also international investors from Abu Dhabi Investment Authority and Global Infrastructure Partners.

In its current form, the post-transaction shareholding from this privatisation exercise will result in 70% of Malaysia Airports being owned by Malaysian investors and remaining 30% by Abu Dhabi Investment Authority and Global Infrastructure Partners. The Malaysian Government will retain special share rights in the entity too, with the Chairman and CEO of the company continuing to be a local citizen.

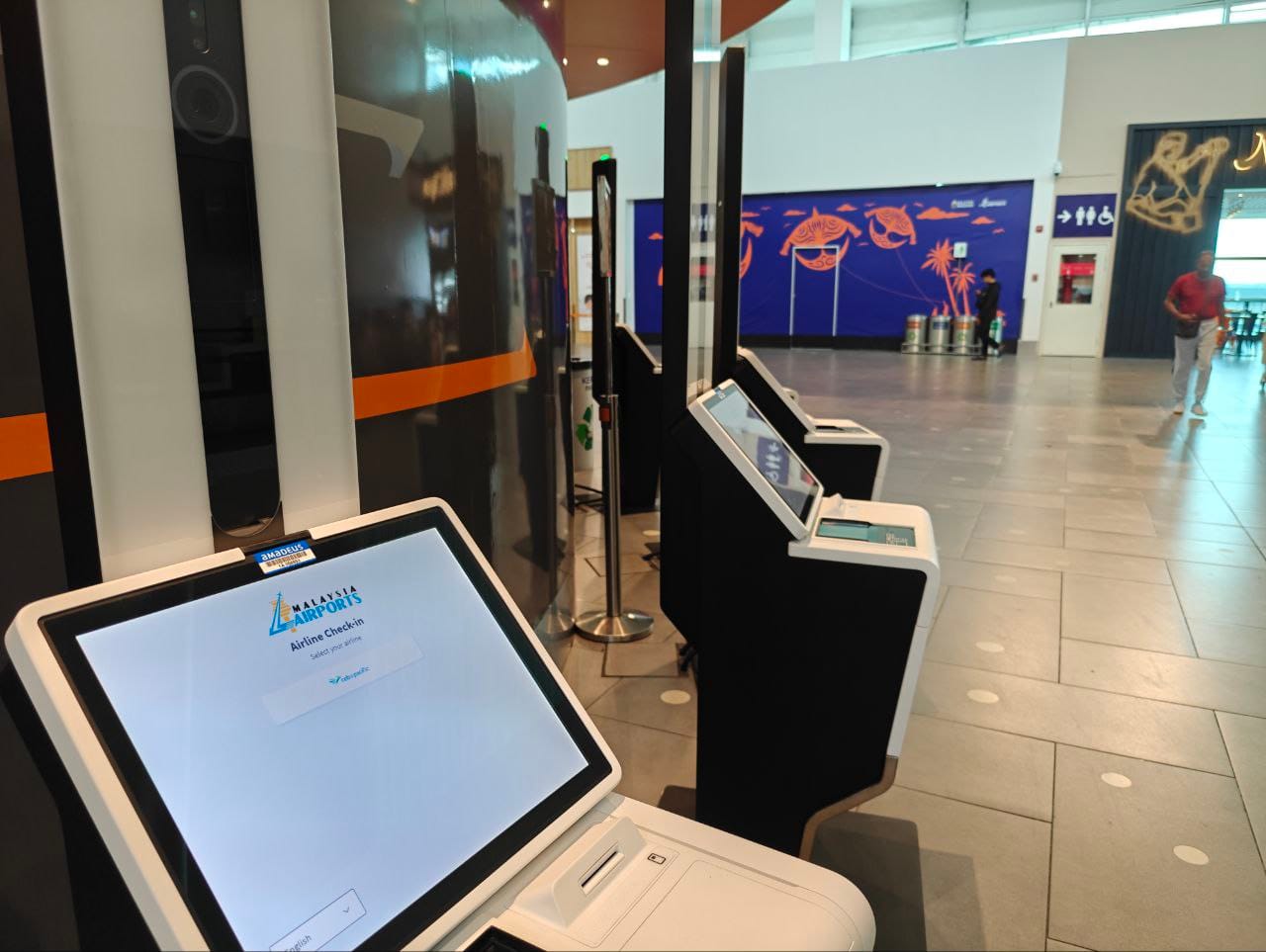

According to the latest consultation paper by the Malaysian Aviation Commission, this deal may bring enlarged benefits economically and socially due to the continual investments by the capital partners. This includes modernising the infrastructure and operations of the airports, raising the safety standards and embarking on capital-intensive projects to create longer-term growth. With this approval being valid and effective for one year, it paves the way for the consortium to proceed with a general offer formally and make further progress with the transaction.

Operationally, expansion works for Penang International Airport have started last month. This is a RM1.5b project to expand the airport capacity to support 12 million passengers annually, and will occur in three phases with targeted final completion by 2028. Other airports like Kota Kinabalu is likely to follow suit with the same funding framework as the Penang International Airport. With these enhancements, the hope is not only to attract more airlines customers but also support the route network expansion of existing airlines.

Other projects are also in the works at Kuala Lumpur International Airport, including the aerotrain service and the baggage handling system. The upgrade of nearby Subang Airport complements the flight connectivity of Kuala Lumpur, in a bid to elevate the position of the city as an aviation hub of choice. With an estimated RM10b to be invested over the next five years, Malaysia Airports is confident of being able to pursue new relationships with foreign carriers and compete regionally with airports in Thailand and Singapore.