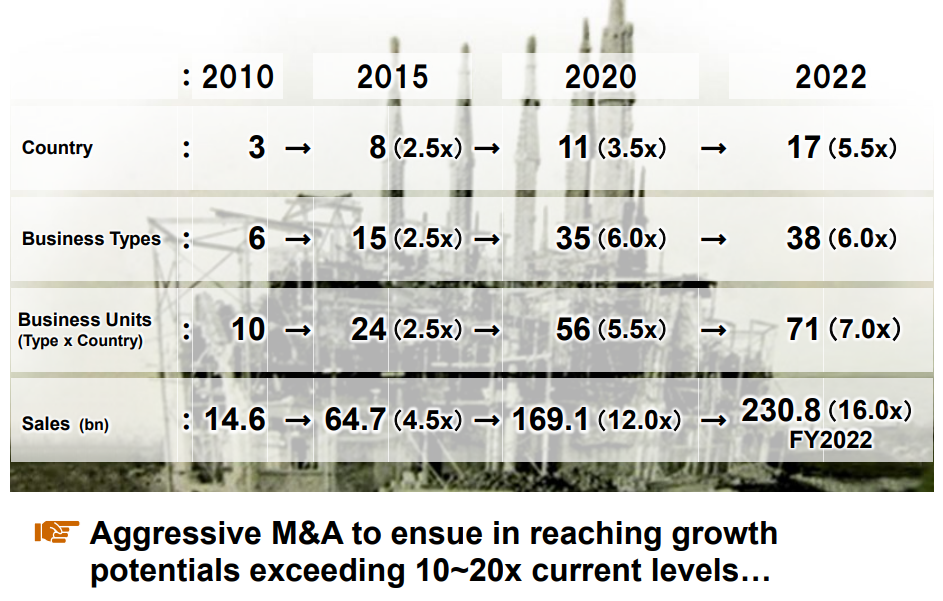

M3, Inc (“M3”) is slated to close its acquisition of Kantar’s healthcare research businesses this month. As an online platform for medical professionals, M3 has been scaling up its business through its programmatic acquisition strategy. Notably, Sony owns a third of shareholding in M3.

For 2023, four acquisition deals have been announced so far. This momentum was carried from last year, where 9 deals were done in what was considered one of the most active periods for them. At the same time, they have also pursued public listings of their subsidiaries and affiliates. The most recent was the listing of CUC in Tokyo, following the prior listing of Medlive in Hong Kong.

We believe that M3 sits at the intersection of the medical and digitalization software industry. They have grew their global presence to more than a dozen countries, while maintaining its leadership in Japan. The business operates under several segments, with its Medical Platform being the largest and most profitable of all. The onset of the pandemic shifted much of the marketing expenses of pharmaceutical companies online, a major driver for the Medical Platform business.

M3 provides an information portal where member physicians can find and access information on products from drug makers. Market research services and identification of participants for clinical trials are also part of what they do. Apart from their medical platforms such as M3.com, they also provide industry solutions for medical players in areas such as site operation and administration, career services and telemedicine.

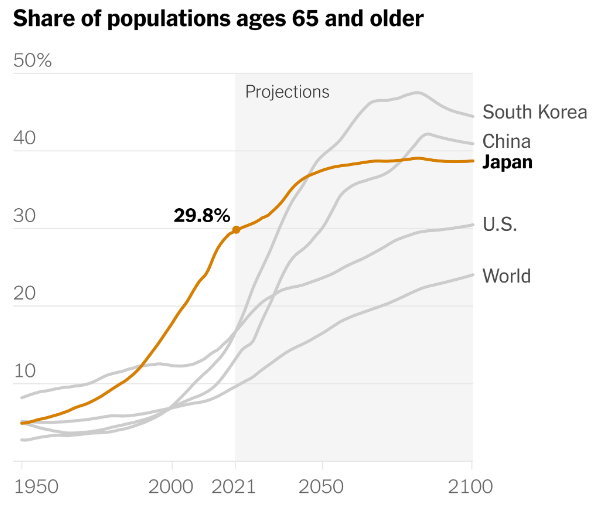

In essence, M3 is positioning itself as the consulting partner of choice for medical clients embarking on digital transformation projects. We believe once the markets recognise that they are more than just a short-term beneficiary of the pandemic, more appreciation will be given to the underlying structural growth story of the business.

It is one of the more modern companies in Japan which is deeply plugged into the healthcare theme of an ageing population. By 2027, the company also aims to grow its overseas contribution to around 40% of its total sales. China, Korea and India are major Asian markets where they already have high coverage among doctor members and panelists.

The potential for M3 to be the pre-eminent player in Asia healthcare is not unrealistic, and there remains substantial white space in the medical industry for the development of digital capabilities. We are sanguine of the opportunities ahead for them given that they can capitalise on their scale to generate synergistic acquisitions and grow inorganically.