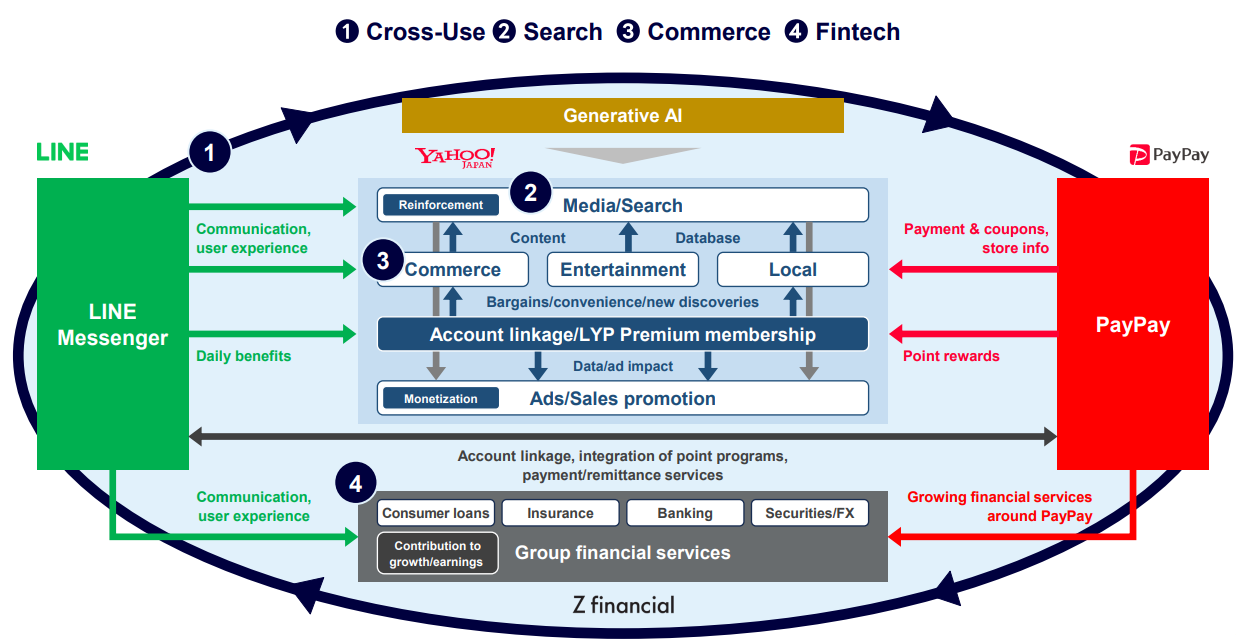

LY Corporation (“LYC”) has begun their service integration for LINE and Yahoo! JAPAN users, now that their reorganisation exercise has been completed. With the ambition to create even more value for their users, LYC is looking at ways to bundle services and benefits in a digital ecosystem combining LINE, Yahoo! JAPAN and PayPay.

LYP Premium, a new monthly membership program, was recently launched as one of the first integration steps. Existing members of Yahoo! JAPAN Premium (which received a boost back in 2017 when it was provided free for Softbank Mobile users) will be automatically migrated to the new LYP Premium platform, while new interested users will naturally sign up for the new program given that it is priced at the same cost of the existing Yahoo! JAPAN Premium subscription.

As early as October 2023, LYC has been encouraging users to link their LINE and Yahoo! JAPAN accounts. This move set the foundation for all future synergies, from convenient synchronisation of app services to cost savings and rewards using PayPay for consumers.

As for the company, LYC will be able to enhance their customer profiling capabilities and make use of the new insights for product improvement and advertisement distributions. With the PayPay integration scheduled for 2024, it will be a key driver to more transactions on Yahoo! JAPAN shopping.

This corporate restructuring and reorganisation have been one in the making for quite some time. Tracing the business history as far back as 1996, Yahoo! JAPAN has gone through various iterations and seen its search and commerce business transformed over a couple of technological cycles.

On the other hand, LINE started as a disaster response app developed by South Korea’s NAVER in 2011, before experiencing rapid user adoption into the core messenger tool for countries like Japan, Taiwan and Thailand. Two years before its public listing in 2016, LINE also began to grow new business areas like payments.

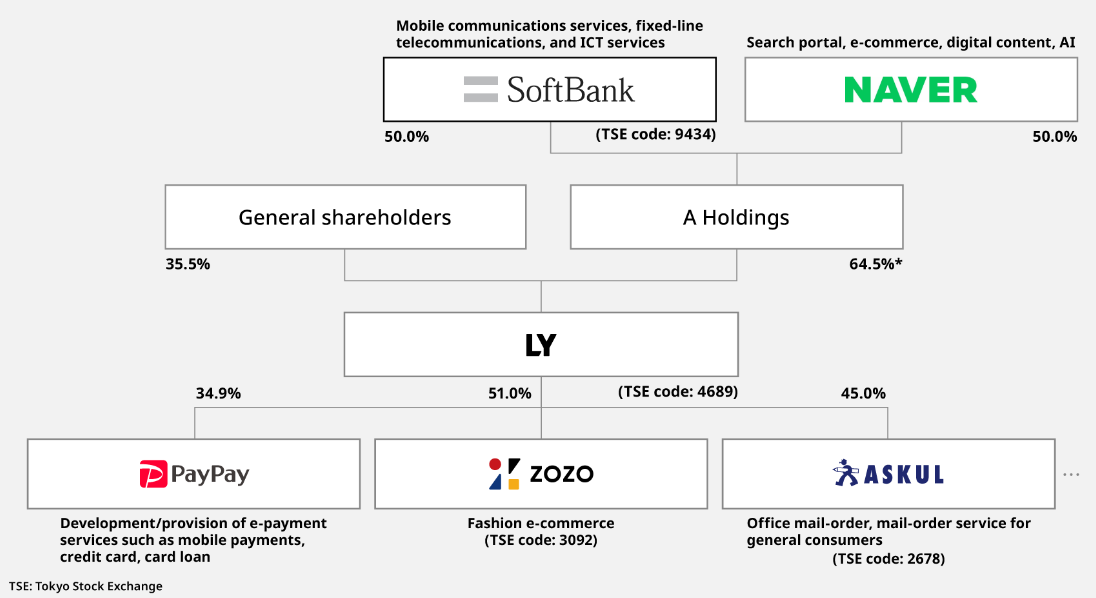

It is no surprise that the relationship between both Yahoo! JAPAN and LINE is one with complexities, because Yahoo! JAPAN is backed by SoftBank, a heavyweight conglomerate in Japan while LINE has a long heritage with South Korea’s NAVER Corp. As a result, there is no doubt that there will be overlapping competition, such as services like LINE Pay and SoftBank’s PayPay in the fintech space.

That said, in late 2019, a Memorandum of Understanding was signed between the two parent companies after Yahoo! JAPAN was renamed to Z Holdings as part of a transition to a holdings company structure that same year. The memorandum was the first of a series of steps taken by Yahoo! JAPAN and LINE to eventually merge in March 2021, after facing a delay from the COVID outbreak.

A key reason for this joint venture was to enhance global competitiveness. Instead of competing with each other, the enlarged organisation will now be in a better position to compete effectively against international technology companies from countries like United States and China.

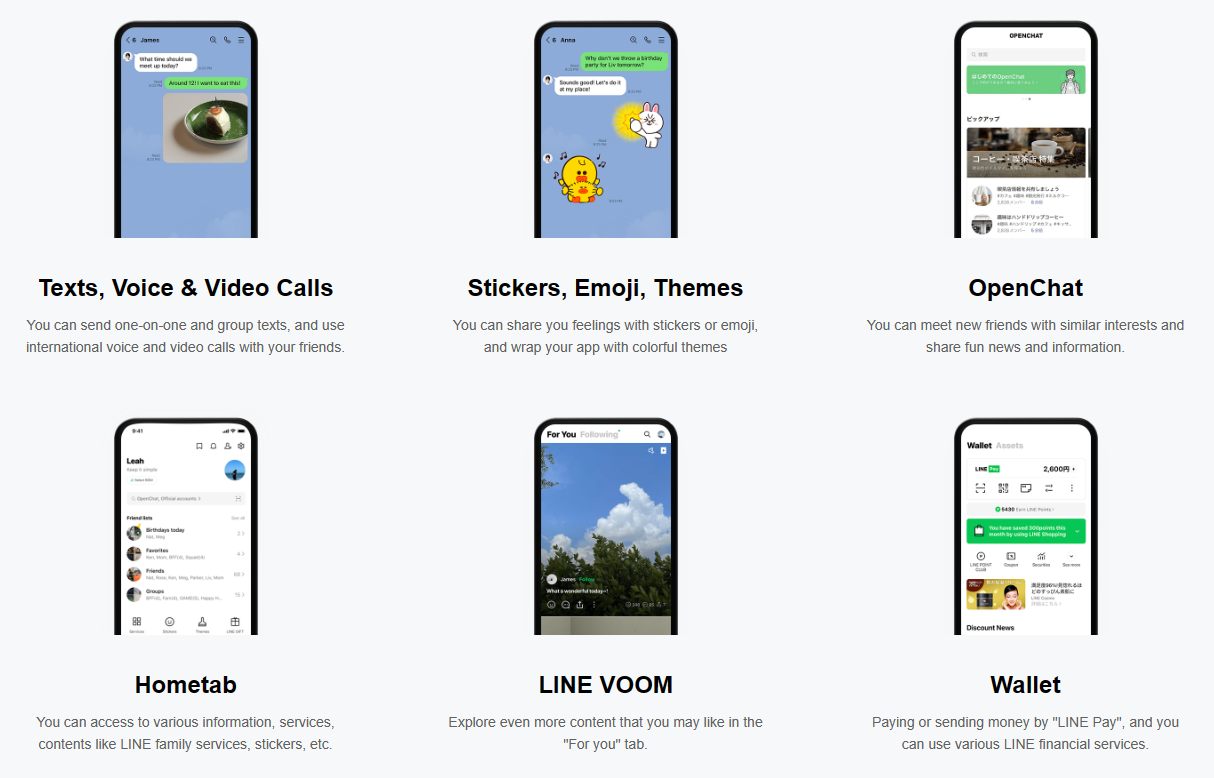

Till date, numerous synergistic integrations have been enacted. One of them was the replacement of LINE Search to Yahoo! JAPAN Search earlier this year. This allows LINE users to utilise Yahoo! JAPAN Search function within the app’s news section, offering higher quality results complete with other relevant details pertinent to the search subject. The sheer scale of their user base means that LYC now services hundreds of millions of users across more than 200 countries and regions. LINE itself boasts about 200 million monthly active users while PayPay is Japan’s smartphone payment service leader commanding two-thirds market share for QR code payments.

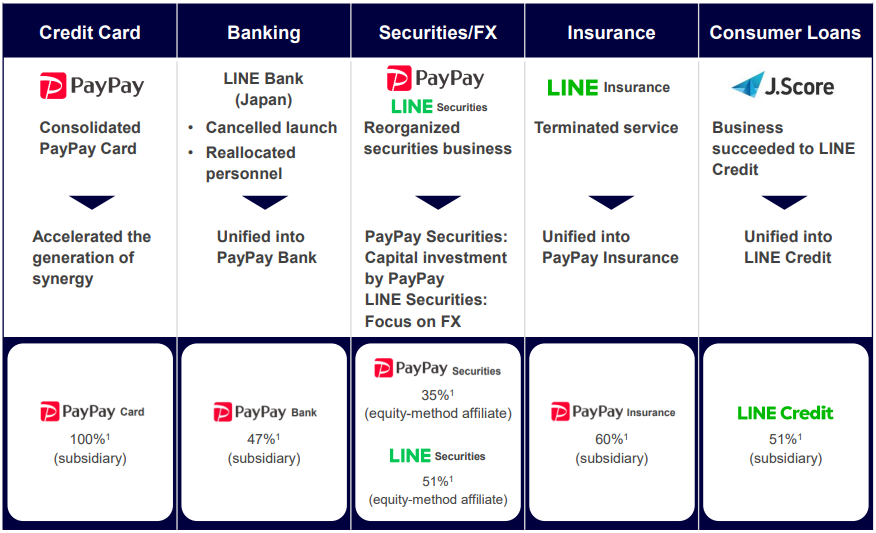

Fintech is a big area of focus for LYC, a segment which is growing and with improving profitability (currently 1% adjusted EBITDA margin). With Japan moving into a cashless society, there is significant growth to be captured during this transition. The ratio of cashless payments in Japan is still relatively low, at around 36% with the predominant cashless method being credit cards. Less than 3% of transactions are code payments. Therefore, with the Japanese government pushing for further cashless payment ratio, LYC will seek to become the key enabler for this digital payment transformation.

There is much to look forward to for LY Corporation. With the account linkages firmly in process, the richer set of first-party data can provide LYC with the much-needed ad pricing power. The cash generated from the profitable businesses can then be funneled to new strategic initiatives such as fintech to position the company for future growth.

Certainly, in the near-term, the potential renewal of the LINE app will be the next step to further enhance the cross-usage of LYC’s products through easier navigation (such as News and Commerce sections) and user retention within the entire LYC’s ecosystem.

Only with the successful integration and subsequent monetisation of the user base will management have the chance to stabilise the business model and bring back their pre-integration profitability in the next three to four years.