As customers waited eagerly in hours-long queue outside Laopu stores, China is witnessing a new household name in the making. On a rising tide of national pride and traditional 'chic', Laopu Gold epitomises the high-end aspirations of consumers. To many, the allure of their heritage gold jewelry strikes the same chords as Hermes, Chanel or Van Cleef & Arpels in the hearts of luxury shoppers.

As gold price soars amidst global uncertainty, customers throng the stores of Laopu and braved hours of queue to enter the stores. While we may think that these are older generations clamoring to invest in some gold pieces (either for wealth preservation or traditions), the reality is that these customers belong to a younger age profile; a demography who is increasingly interested in gold accessories, be it intricately crafted jewelry or decor objects with modern immaculate designs.

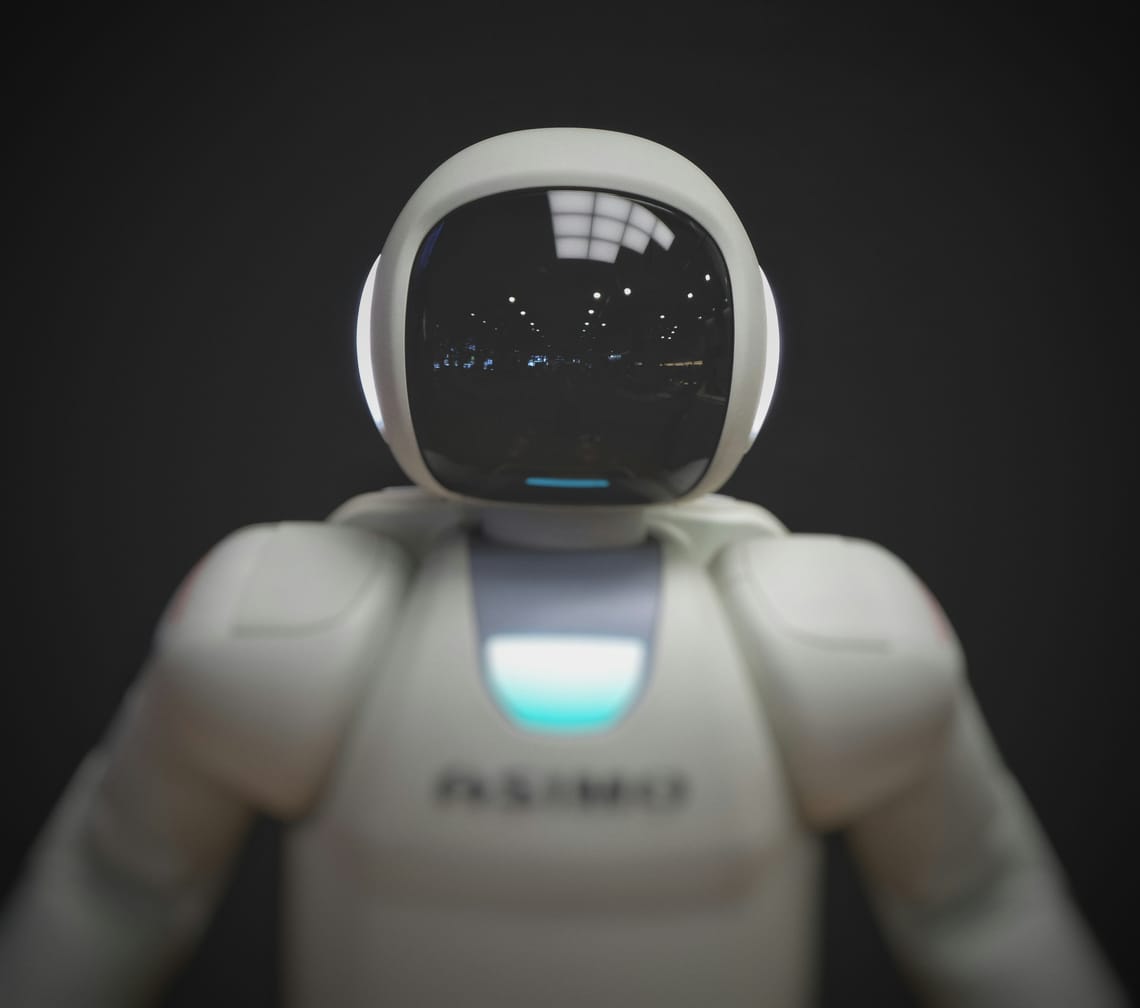

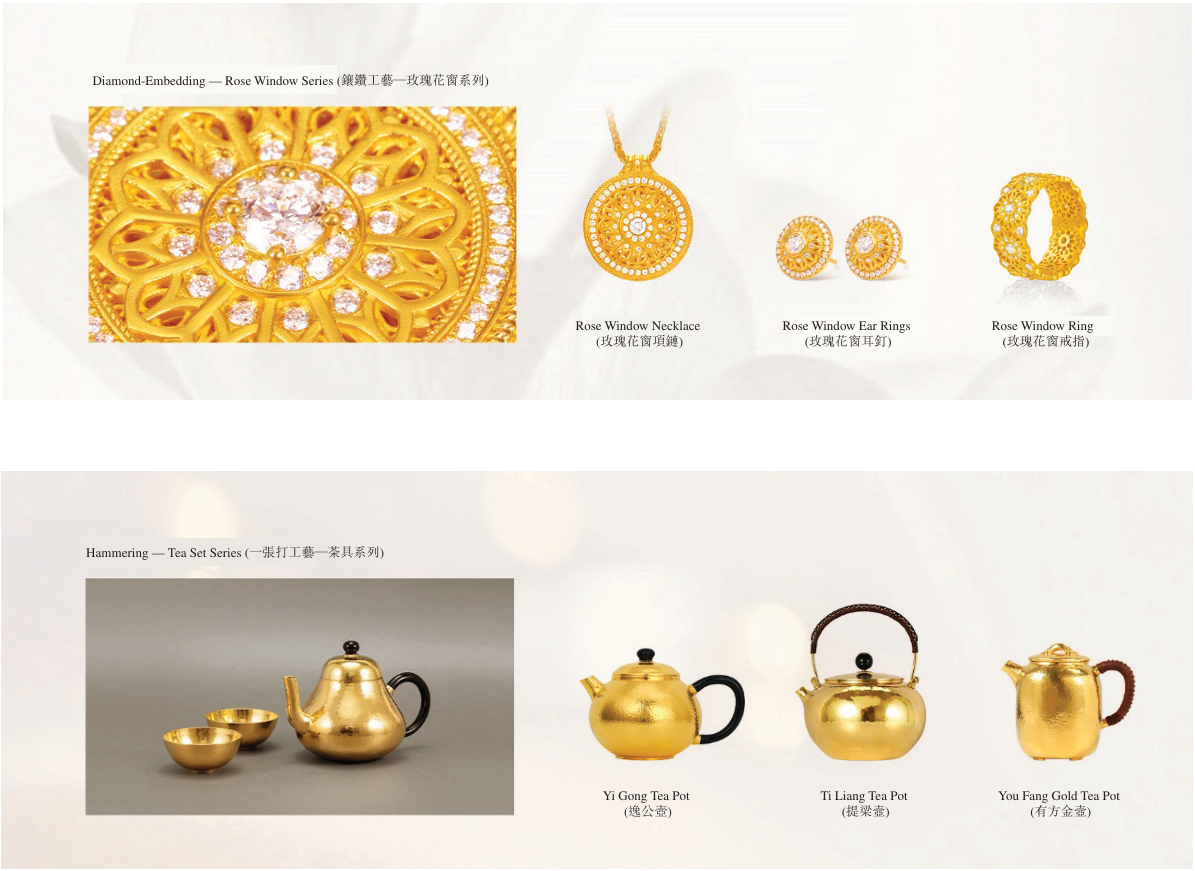

The broader gold/jewelry industry is mainly a stronghold of the European luxury brands till this date. That said, Laopu is trying to muscle itself into the high-end luxury jewelry space with its modern take of heritage gold. For a start, there are many craftsmanship techniques such as hammering and filigree, to more advanced ones like inlay and heat treatment of enamels.

Steering away from the commodity approach towards gold accessories, Laopu focused and invested heavily on the branding and marketing side of the business right from the get-go.

For multiple reasons post pandemic, China's appetite for gold has increased dramatically and sales for heritage gold jewelry has likewise increased several folds. The appeal for the younger clientele base hinges largely on the modernity of Laopu's gold products, a local culture-first consumption trend, as well as the age-old perceived appreciation of gold as an investment asset class.

The potential for this company lies in its multiple growth levers. Real estate and store network play a critical driving force for Laopu, given that its number of stores is less than 50 in the whole China currently. More importantly, it has relied on and successfully demonstrated its strong sale-store sales growth momentum to further propel the business despite starting on a small scale.

As they only command low single-digit percentage market share, many of their existing stores in the high-end luxury malls are not yet in the prime locations or levels of the malls. However, with their rapidly-improving store performance and the ability to draw crowds, it is highly likely that Laopu can negotiate to relocate to better spaces in a mall and elevate its brand by clustering amongst the top-tier foreign luxury brands.

Brand equity and perception can also be reasons why the business may not want to grow too aggressively in terms of store count. This replicates the real estate strategy of high-quality boutiques from foreign exclusive brands like Van Cleef & Arpels, as opposed to the mass distribution strategy of competitors like Chow Sang Sang.

While it is tempting and almost natural for homegrown local brands to target volume of sales given the vast market potential of the masses in China, Laopu is still firm on maintaining an air of exclusivity, resulting in them being extremely selective in where and how they are managing their store presence in the higher-tier cities across the country. With its stores being more concentrated in Beijing currently, there are plans to increase its footprint in other first-tier cities like Shanghai.

One way for it to expand is to penetrate the same commercial districts where the big foreign jewelry brands are situated, since Laopu is likely to be appealing to similar clientele and levels of purchasing power. Tiffany and Cartier are the most mature in their distribution networks in regards to their retail store footprint in the main shopping areas of China. This serves as a good indication of how much room there is for Laopu to expand its own stores without cannibalizing its own sales.

Aside from its real estate, another well thought-out business positioning is their pricing model. Its investment in stores (through its self-operated format) and training of their own sales staff provide Laopu with higher degree of control over their brand, with the eventual goal of maintaining product prices and achieving durable profit margins.

Instead of pricing their products according to the volatile movements of gold prices, Laopu takes control of their own pricing and may choose to defend its entry-level prices or even raise prices to communicate its high-end proposition to customers. The sticky prices can help to add another element of capital preservation for customers who see their purchases as an investment, by limiting store discounts as well as helping to support prices in the secondary market.

Its high-end pricing also directly resulted in its sale-store sales metric blowing past local peers like Chow Tai Fook in the heritage gold segment. Based on latest trend, Laopu has the ability to refresh its product offerings by about 10% of its total product catalogue a year, with half of them being iterations and the other half being new products. This balance can help maintain their brand heat and momentum by not only attracting new-to-brand customers, but also actively engaging its existing membership base and allow them to consistently follow their new product launches.

Without question, Laopu is becoming a leading culture-carrier in China. The trend of national pride arising from recent commercial successes such as Black Myth: Wukong in the gaming community and the recording-breaking box office of Ne Zha film compounded this fact, and many industry-watchers are optimistic that China may be entering a golden age where successful homegrown brands embrace both traditional culture and modern technology in their businesses.