The race towards Artificial Intelligence (“AI”) is leading to an explosion in demand for SK Hynix’s advanced products. As a leading memory-maker, SK Hynix should be able to capture a significant share of high bandwidth memory (“HBM”) market growth. Specifically, HBM3 and HBM3e growth may drive HBM to make up more than a fifth of the entire DRAM market by 2025. All these are on the back of a global AI push, as HBM3 enables the development of high-performance computing applications.

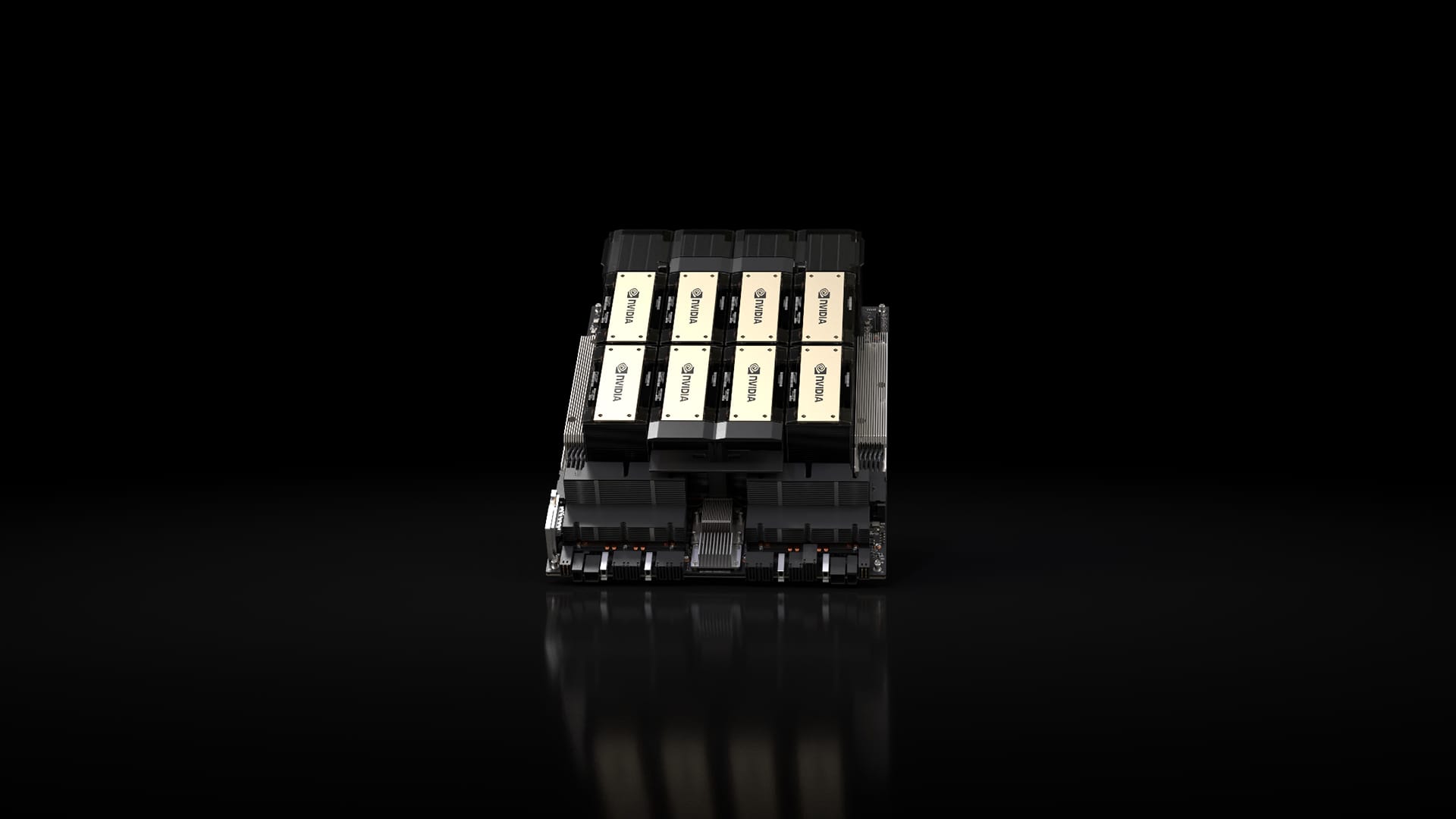

As it currently stands, AI servers contain more than double the DRAM content (also known as DIMM) of high-end servers. For the HBM side, AI servers can have almost triple the HBM content compared to high-end servers. Therefore, the adoption and proliferation of AI servers such as the DGX A100 and DGX H100 systems will help drive the demand for SK Hynix’s AI-related products. With plans to double their HBM capacity in 2024 and customers ready to fully absorb the output increase, SK Hynix is likely to be able to establish and maintain its market leadership in the HBM3 market (about 50% market share; with Samsung perhaps slightly lesser and Micron a distant third place).

Just a few days ago, NVIDIA further announced HGX H200, the first GPU to offer HBM3e which delivers 141GB of memory at 4.8 terabytes per second. The pace of AI development and technological transition will thus supercharge growth in the capacity and bandwidth of these computing systems. Consequentially, AI servers are expected to make up about 15% of all server shipments in the next 3 to 4 years.

Apart from these AI servers buildout, SK Hynix is also seeing some light in terms of where the general semiconductor cycle is. Memory chip prices show signs of bottoming out. This trend will continue as there have been disciplined reduction in production output with chances of an accelerated recovery as customers return to their inventory restocking phase.

In addition to the slight stabilisation in average selling prices, bit growth for SK Hynix’s DRAM and NAND registered 21% and 6% growth respectively. While NAND may still be pressured in the near-term with fab utilisation continuing to be cut, DRAM is faring better due to current shift towards higher-value products like DDR5 and HBM.

Certainly, as the memory market adapt to the new age of AI, a risk that should not be overlooked is the supply chain. Increasingly, the semiconductor industry is gaining political interest as an issue of national security. The ongoing chip restrictions between US and China require suppliers like SK Hynix and Samsung to navigate the conflict strategically.

While the companies have obtained waivers to allow them to ship manufacturing equipment to their China plants for now, it can still present an uncertainty risk to their supply chain management if conditions change. Given that a significant proportion of SK Hynix production capability is situated in China still, longer-term contingency plans have to be made to mitigate future supply chain disruption if SK Hynix wants to fully capitalise on this AI-driven industry growth.