Back in late July 2023, GoPay was launched as a stand-alone app to tap on Indonesia’s burgeoning users both within and outside of Gojek-Tokopedia ecosystem. With GoTo’s ambitions in becoming a SuperApp, a business strategy similar to many of the largest tech platforms in China, GoPay is another channel for the largely underbanked population to get familiar with GoTo’s products and services.

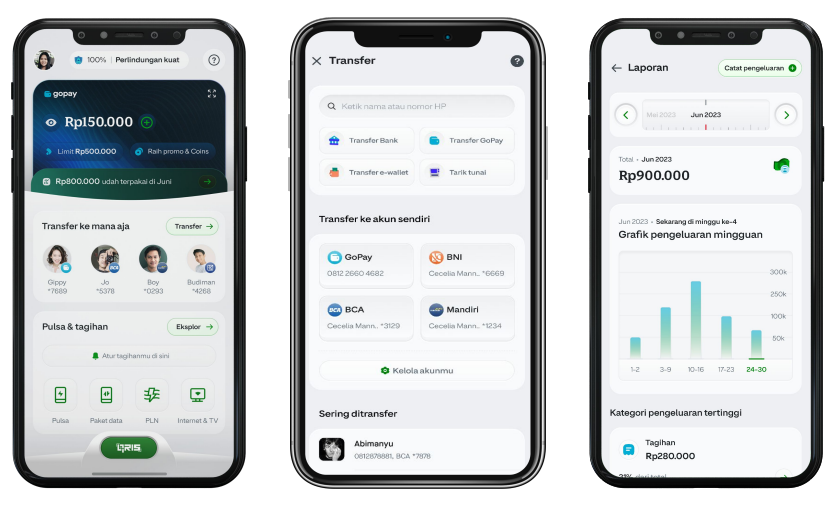

In its entirety, GoTo is already a new-economy behemoth with gross transaction value on their platforms single-handedly accounting for low single-digits percentage of Indonesia’s country GDP. At around 70 million annual transacting users, GoTo aims to extend their reach via GoPay to a greater share of the country’s population. To enhance the penetration rate into lower-tier cities where more users may have lower-specifications smartphones, the GoPay app is designed to be ‘light’ with a simple user interface. Core functions are on transfers and bill payments for now.

A month later, in August 2023, GoTo also announced a new line of services called Hemat to further capture lower-end budget-conscious users. This offers a cheaper alternative version of GoCar and GoFood, which are on-demand services for transportation and food delivery. How Hemat differs is that options are more limited by proximity, vehicles may be smaller, and food delivery time may be longer. GoTo is able to provide these services by fulfilling more orders at once, hence profitability from the unit economics may not actually be worse for Hemat.

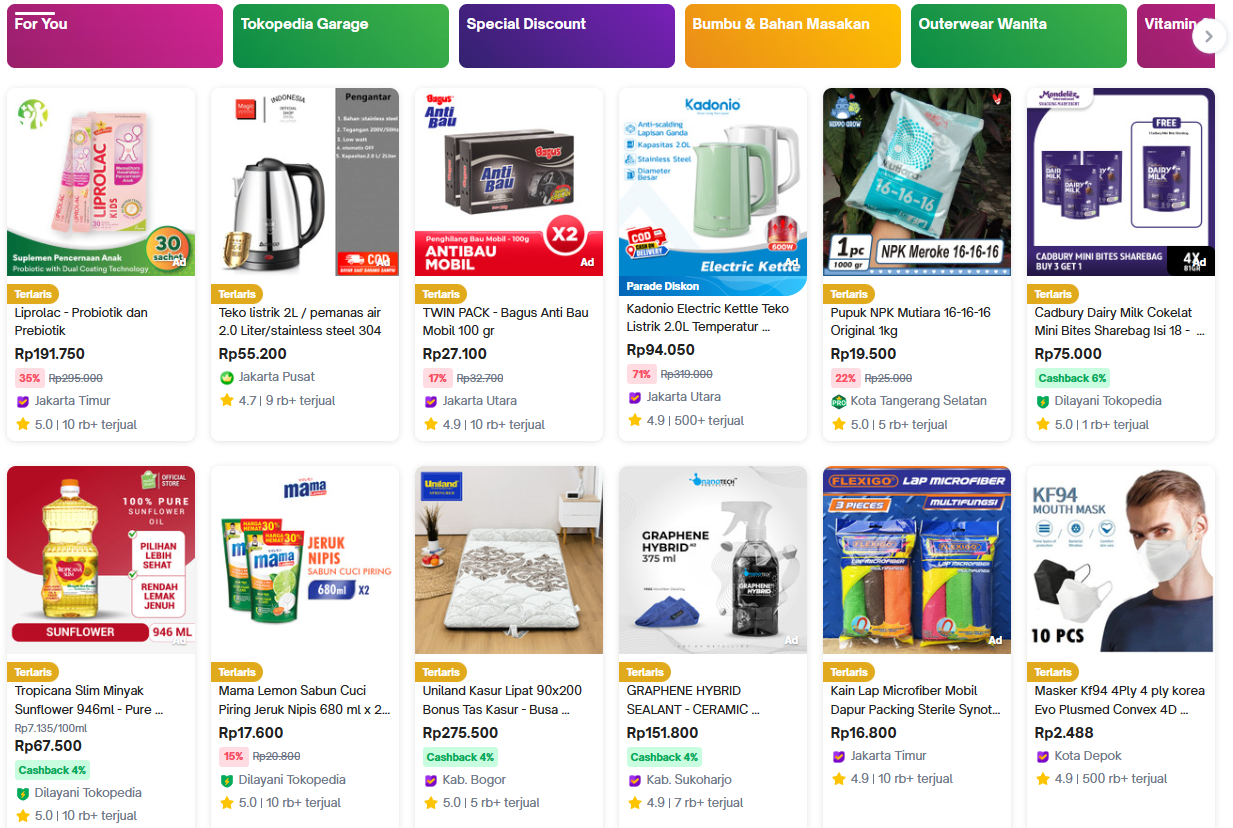

Other than on-demand services, GoTo also have a foothold in Indonesia’s digital economy through its e-commerce arm, Tokopedia. Beginning this year, GoTo and its competitors like Shopee have been cutting back on promotional campaigns and increasing merchant commission rates. That had led to higher take-rates and better operational metrics for both companies.

However, the e-commerce landscape is now seeing intensifying competition from potential new entrants like TikTok Shop and Temu. All these e-commerce players have budget consumers as their addressable market, going after a similar pool of users even though some platforms may be more popular for some product categories. For example, Shopee has fashion as one of its leading category while Tokopedia may be stronger in electronics.

Beyond the short-term, GoTo Financial may be the key to unlocking the latent value of Indonesia demography. Being the third most populous country after China and India in Asia, the relatively low GDP per capita base provides a tailwind for bankability as income levels rise. Cashless transactions are also more efficient and widely-accepted due to smartphone adoption (currently over 70% penetration rate). The runway for financial innovation is long for GoTo and they have already made inroads in areas like lending and insurance. Credit card only served a small portion of the population, likely in the mid single-digit percentage. Therefore, the path to Indonesia’s US$5,000 GDP per capita will underpin the corresponding growth of GoTo’s digital payments and loan book.