Budweiser APAC is a leading beer business in Asia, part of the multinational brewer Anheuser-Busch InBev. After some initial uncertainty in seeking a flotation, Budweiser APAC came to Hong Kong’s public market in September 2019. It has a portfolio of more than 50 beer brands and has also since expanded into other drink categories such as energy drinks and spirits.

Further up the supply chain, the company operates 47 breweries and 51 distribution centers across China, Korea, India and Vietnam. Most of the breweries are concentrated in China followed by India, while South Korea has the highest number of distribution centers.

With the untimely market developments such as lockdowns and social distancing rules, Budweiser APAC experienced a disruption in its business throughout the initial years of its IPO. However, as one of the highest quality brewers in the region, they captured the rebound in sales since last year from the reopened economies and now continue to stay on its premiumisation path.

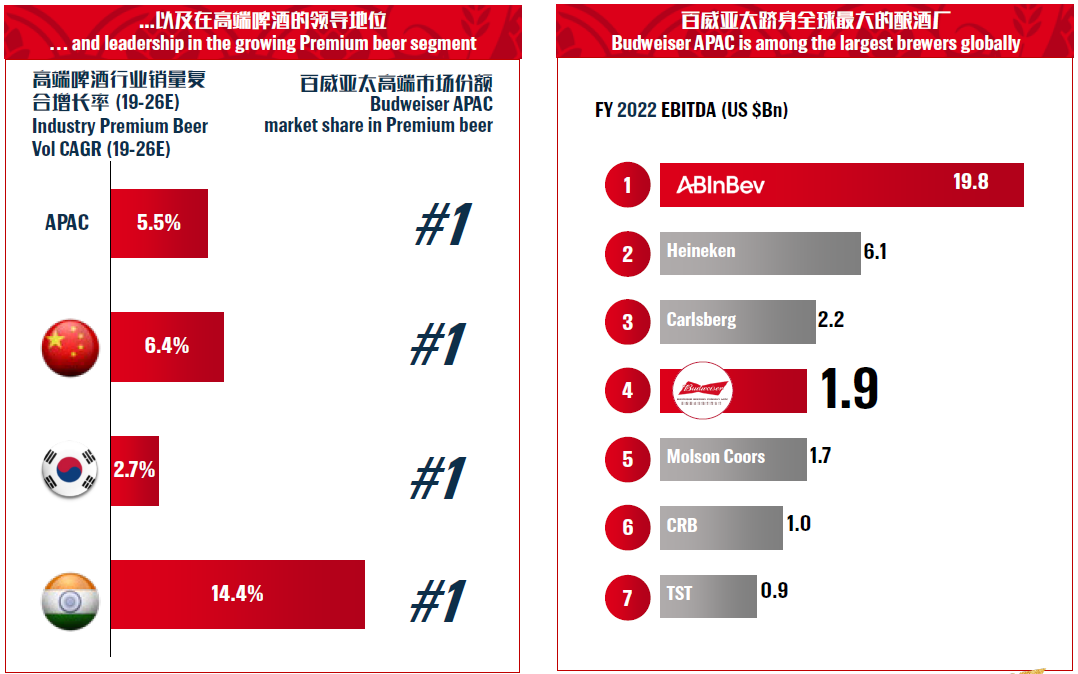

Budweiser APAC currently operates in key countries such as China, South Korea, Japan, Vietnam, and India. These are markets where consumers already have high income or increasing propensity to spend. The opportunity for them lies in the strong pricing power they command. Operating performance has been resilient, and they managed to gain market share in several of the markets they serve. South Korea, for example, is one where Budweiser APAC grew their market share by 1.5 percentage points against competitors amidst the pandemic.

For the year ended 2022, Budweiser APAC recorded 88 million hectoliters in beer volumes. Even so, China remained the largest overhang, boring the full blunt of the on-premise channel closures. Moreover, cost inflation took a bigger impact on their business as supplier prices also rose for raw material and packaging.

Leaving 2022 behind, beer volumes came in at 22 million hectoliters for first quarter of 2023. It was a 9.1% quarter-on-quarter increase from 2022, driven by recovery in China when pandemic restrictions were finally lifted in January 2023. China itself grew by 7.4% in terms of volume while pricing improved by 3.2%. This led to a commendable revenue expansion of nearly 11% in China.

Even as we expect commodity cost inflation to taper (aluminium prices have stabilized but less so for barley), Budweiser APAC may choose to commit more sales and marketing expenses to strengthen its branding. This is apparent with their South Korea’s marketing campaigns, with more promotions planned for the summer. In China, the company is also in the midst of marketing their brand, Blue Girl, into key expansion cities through the celebrities and key opinion leaders network.

In recent months, there have been various economic data out of China which pointed to slowing household spending. In a soft macroeconomic environment, it is true that consumers may opt for cheaper alternatives in a phenomenon called trade-down. However, this is likely to affect the entire industry and make it harder for lower-quality competitors instead. In fact, as reported by the company, the premium segment of Budweiser APAC’s brand portfolio still experienced double-digits growth from when it was listed.

Lastly, on the cost side, there is a possibility of a reprieve in the import tariff of Australian barley. Two weeks back, China delayed a decision to remove the 80% tariff imposed on Australia’s exporters. This was a deal which was drawn up earlier in April 2023. The consideration will extend for one month till 11 August 2023. A resolution to this World Trade Organisation dispute will alleviate the cost pressure for Budweiser APAC, pertinently for an improvement in its 2024 margins.

What is most compelling is the fact that Budweiser APAC participates in both China and India, the twin growth engines in Asia. China may dominate the headline for now, but India is rapidly catching up to be a substantial market for the company with them commanding about two-thirds market share in India’s premium beer category. Taking a step back, India is still lowly-penetrated in beer compared to China, so it is more likely for Budweiser APAC to benefit from industry growth than having to compete for market share in a maturing space. With Budweiser APAC's experience in China, it is likely for them to be able to replicate the success to fulfil the long-term potential with India.