The global luxury industry has reeled from the macroeconomic slowdown in China. However, the previous boom from 2015 to 2019 had already solidified Chinese consumption as the structural driver of European luxury houses. In fact, 2022 provides a low-base effect to allow for a rosier growth prospect in the coming years.

While European consumers are relatively resilient, United States consumers are now retreating from the revenge spending observed after their economic reopening. It is therefore necessary for Chinese consumers to pick up the slack in order to maintain the business momentum for these luxury companies.

Building on core brand equity and adapting to new trends like ‘quiet luxury’ are pivotal in capturing market share in this competitive landscape. This was illustrated by the recent ‘Ancora’ campaign launched by Gucci, an important brand under Kering Group.

This has been widely touted as a great reset for Gucci, dialling back the loudness under the prior creative direction of Alessandro Michele. Promoting a more subtle, minimalist design is at the core of the latest debut by Gucci’s new creative director, Sabato De Sarno. At the moment, it has yet to be seen if Gucci is able to revive its fortune since we are still early in the marketing and retailing phase for this Spring Summer 2024 collection.

Outside of Gucci, Kering’s other brands are still undergoing wholesale rationalisation. These are being accelerated at Bottega Veneta and Balenciaga. Saint Laurent likewise is leaning very swiftly into their own retailing. The industry as a whole seems likely to undergo further consolidation, as seen by various deals struck in the last few months. Kering themselves had already announced a pending EUR1.7b acquisition for 30% stake in Valentino earlier in July 2023, with an option to buy over the remaining 70% by 2028.

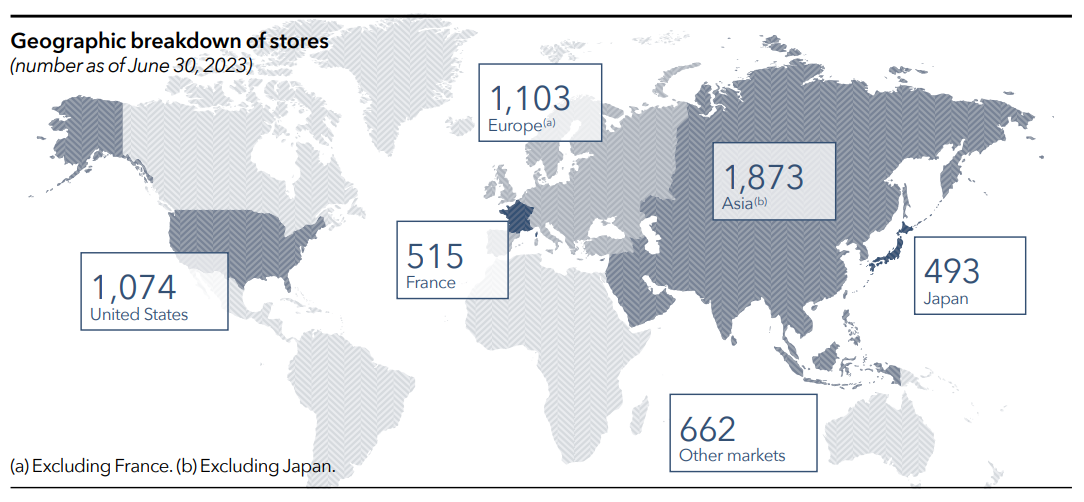

As for US listed companies, Estee Lauder completed the US$2.8b acquisition of Tom Ford in April 2023. Tapestry is also acquiring Capri for US$8.5b, a recent move that marks the high-profile combination of brands like Coach, Kate Spate, Versace and Jimmy Choo. This will allow them to have the scale and resources to compete more effectively with the other global competitors. Consequently, an important priority is to rely on the direct-to-consumer model to broaden their reach in Asia and Europe.

One way that companies use to further develop the luxury market in China is to focus on expanding the local stores, as opposed to the traditional approach of relying on offshore spending by the Chinese luxury spenders in European cities. The price differential between the two geographies has narrowed in recent years and travel restrictions meant that the Chinese consumers had the opportunity to experience the interaction in China’s local flagship stores instead.

Perhaps the best reflection of the vast potential of the Chinese market can be seen by the stellar performance of Moncler. High growth in store openings and strong storytelling have been able to contribute to its above-peers business margins. An example of recent traction can be seen by the new Moncler flagship boutique at Plaza 66, Shanghai where we saw the opening event reaching 49 million people on local social media.

Deeper investments in China can also be seen in marketing events like the Gucci Cosmos exhibition in West Bund Art Center, Shanghai. Online presences are also being boosted from collaboration with digital e-commerce players like JD.com.

What makes China special is the structural tailwind from a still under-penetrated market. While much has been said about the offshore spending power of Chinese consumers in European cities like Paris and Milan, it was the beginning of 2020 that we saw a shift in consumption back onto the shores of China. In urban metropolises, luxury spending per capita is still a fraction of major developed economies like US and Japan. After all, China still has a high industrial base such that personal consumption as a percentage of GDP has ample room to grow. Soft luxury products certainly fit into the aspirational demands of the mass affluent and China’s new working class.

The ambitions of the global luxury players in China can be seen in the heavy investments into customer education and relationship management. A multi-pronged approach to connect with a younger demography also meant that brands like Louis Vuitton branch into lifestyle-centric presence such as restaurants, hotels and gyms. And this is because what differentiates China luxury spenders from other markets is the concentration of young customers. The bulk of them are under the age of 40 and their first purchase usually starts around 25 years old.

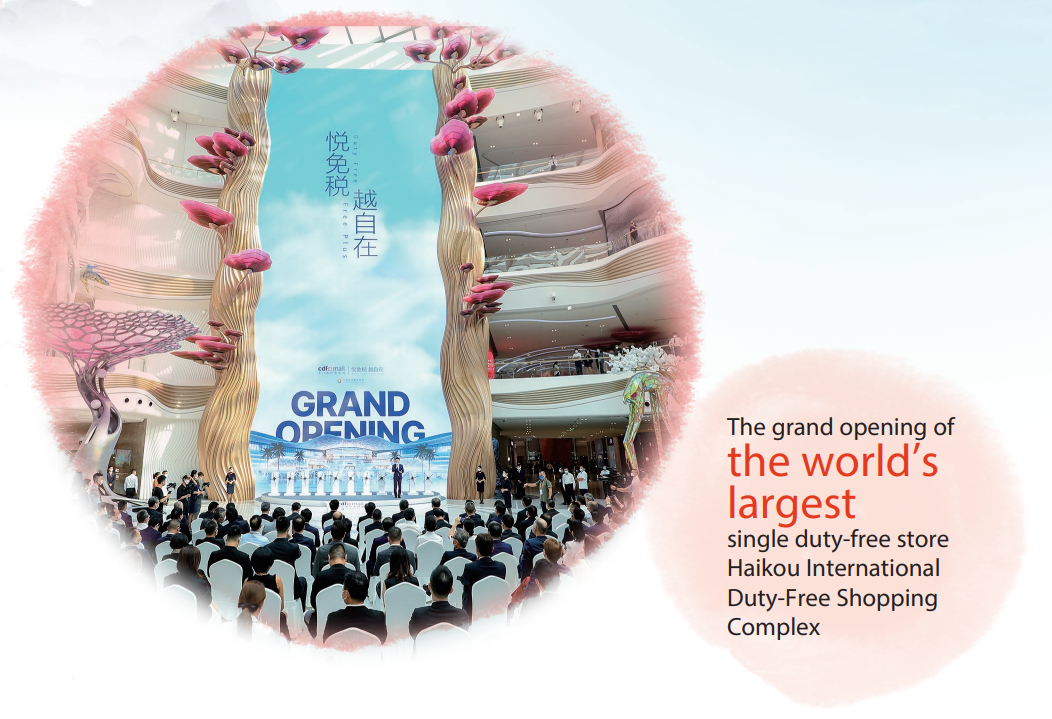

Their greater appreciation for domestic travel and experiences also opens up travel retail as a new growth channel. Hainan as a duty-free destination is an epitome of this trend. Many international companies have since shifted their focus and resources in developing this sales channel, when China Ministry of Finance spearheaded this offshore duty-free retailing initiative back in 2011. The ensuing success stemming from Sanya propelled Hainan to be a regional anchor for China’s luxury market.

Lastly, when consumer sentiments recover alongside the local economy, it is increasingly likely to see luxury companies double-down on their localisation strategy, creating relevant hyperlocal content which can relate to a new era of consumers. It is our belief that social media content is still king, but an impactful storytelling will require a seamless transition into offline retail in order to provide an effective customer journey. After all, many ambitions of international luxury groups are anchored on this evolution of new luxury retail.